After two years with around zero returns (but a lot of volatility), like many others the GSP portfolio sprinted towards year end managed to eke out a return of +13% for 2023. This compares poorly to MSCI World at 25%, in-line with MSCI World ex USA and quite favorably versus Hang Seng at -14% (what an insane spread). I’m still quite far off my ATH which was set back in May 2021.

2023 Returns

Returns since blog start:

Thoughts about the past year

The start of 2023 was the middle/end of the massive Hong Kong stock rebound due to China reversing it’s Zero Covid policy and literally overnight removing all Covid restrictions. The bulls were out and it the big re-opening revenge spending was anticipated. I was fully loaded on HK stocks, having further increased my positioning in the 2022 autumn crash, using mainly my Swedish Match buyout proceeds. I knew I took some risk increasing my position so heavily to HK stocks, but the sell-off was just too brutal and quick, there had to be a bounce. Luckily for me it came and when it had run it’s course I reduced my HK positions again and have continuously over the year had as a rule for every increase in HK stocks I had to make an equivalent decrease in other HK stocks. This basically saved my year as Hong Kong continued it’s brutal slide after a bounce which only lasted until end of January.

Portfolio composition beginning and end of the year

The main reason Hong Kong is still such a significant weight is spelled Modern Dental Group (3600.HK), which is up an amazing 78% in 2023 in a market where the Hong Kong small cap index was -23%, just incredible. Due to the meteoric rise of ZimVie at the year end snap, it was only my second largest position but after some profit taking the last week in ZimVie, Modern Dental is back on top and remains my highest conviction idea.

2023 the year of bad portfolio calls

So if selling Hong Kong stocks (but keeping the MDG that bucked the trend) into the January rally was a master stroke a lot of other portfolio changes was rather the opposite. I prided myself in the past with how my portfolio changes added to my returns and so far almost every year my portfolio changes have been accreditive (something I evaluated quite thoroughly). If we disregard from the “HK moves”, 2023 was the first year I failed miserably at this, basically selling huge winners and adding to losers. Let’s have a look:

Synektik – I had done a full write-up on Synektik the Polish healthcare company in the past (company installing Da Vinci robots, servicing and production of other contrast fluids). My case was built on that the upside would come from the cardiotracer and as that did not materialize as I had hoped, I disregarded how well the rest of the company was doing and sold my shares at 35 PLN per share. Synektik today trades at 91 PLN per share.

GreatView – I could not take more pain in GreatView Aseptic, I company I held and covered closely for years when the majority shareholder sold their shares to Yili. Their major customer Mengniu got upset with the competitor having influence over the company. I almost bottom ticked my final sell at 1.65 HKD, there would have been plenty of opportunity to get out above 2 HKD if I just kept my cool. What Jardine Group did here I will never forget and I will never touch anything which is under their influence ever again. As a small side note, the Yili/Mengniu conflict seems to have been resolved with a share issuance to Mengniu.

RaySearch – I had spent considerable time researching this company (full write-up done). But the question was if there was trouble on the accounting side, I felt decently comfortable, until the new CFO (again) was fired from the company. I could not believe it and decided I lost my trust in the CEO, I sold all my shares (I had built this up to one of my largest holdings at the time). Again I more or less bottom ticked the stock for the whole year, selling at 57 SEK. The share trades today at 90 SEK. This one was the most bitter of all, due to the high conviction I had in the companies products (but not enough conviction on management). The market later choose to focus on the results, which was really good the rest of the year (after I sold) and stock marched steadily up from where I sold it.

Other noteworthy stocks

CNOOC – The exception from my “rule” of no increase of HK holdings, was CNOOC. This was a short term play on picking up two dividend payments in less than 4-5 months time. CNOOC paid out 0.75+0.59 HKD per share over the summer period. So I picked up shares end of April in anticipation of this for 12.3 HKD per share. With some luck the oil price went up, so not only did I get my dividend but also managed to sell my shares (in two tranches) at 12.8 HKD per share. Even in a shitty HK stock market sentiment you can find good trades. If one want’s oil exposure as a high dividend play, this is still one of the best ways globally to get that.

PAX Global – This has been one of my top holdings, a high conviction position that I fairly “suddenly” changed my mind about. First I reduced my position during the January bounce and still sold some shares into Feb and March. End of August I exited my position fully, I just felt that I had given the management the chance to further improve dividend payout ratio, but they didn’t really, at a time when it was really needed. On top of that I had this fear that due to trade wars, USA would go out and ban payment machines made in China. This is wild speculation on my side and rather a black swan event but I believe it could happen, in this market PAX would be down 50-60-70% on such a day. I couldn’t live with that tail risk as there were other safer ideas that I really liked. In a better environment for HK stocks with less geopolitical overhang, even if PAX management is not the best in terms of capital allocation I still think this is a very interesting company, go anywhere in the developed world and you bump into PAX payment machines, its pretty amazing.

L’Occitane – Someone on Twitter made me aware of how L’Occitane’s latest purchase Sol de Janeiro was performing really well. Since I followed this stock for years it was quite easy for me to pick up the threads and just read about on the SdJ brand, which was new to me. To more I read and listened to influencers etc, I realized they had striked gold with SdJ. I bought a medium size position just before the market started to reprice the stock on a rumour of a buy out from the majority shareholder. Long story short, a really strange turn of events happened – again! Kind of a theme in stocks I’m in unfortunately, so the deal was on the table and then the majority owner turned around and changed his mind. I thought the buyout made ton of sense, apparently he didn’t. I would have liked to book a win in a tough market, instead I get a chance to own a company with a really fast growing product. I tried to benchmark how popular SdJ is on social media etc, to me it looks like it’s hitting very high basically among top 10-15 cosmetics brands worldwide. I expect monster sales from SdJ in the next report and I hope the majority owner regrets not buying out the company on the cheap.

Marimekko – In my rotation away from HK I have tried to find new good ideas. The one that worked out so far and I still believe in long term is Finnish designer brand Marimekko. I think this is a typical example where someone like me, with a Nordic background living in Asia can spot something before most people do. I believe Marimekko as a niche brand has a very strong market position among the small group of people that are drawn to their type of design. The brand is extremely popular in Japan and trying to replicate this in the rest of Asia. They are doing clever cooperation and cross-overs with larger brands, most recently Uniqlo. It’s always hard to guess fashion trends and Marimekko is not a super cheap stock here but I do think they will succeed decently well at minimum with their Asia expansion. So far I’m up some 30% on my position so market also seems to agree. What I like with these smaller fashion stocks is that you have kind of an imbedded call option if the brand really hits a craze. For example Swedish company Fenix Outdoor did such a journey 10-15 years ago with their Fjällräven backpacks. This was a brand we Swedes knew since we grew up, but they took that heritage and managed to push the brand worldwide and again especially in Asia. Marimekko has a similar strong brand for Finnish people but the brand is almost unknown outside Finland. If Marimekko manages half of what Fjällräven did I will do really well.

Thought’s about this blog and it’s future

For the long time reader, one would have noticed how the pace of writing has decreased the past few years. This has partly been due to not fully finding the same motivation to write but also some health problems, which now are finally fixed! In 2023 I only did 5 posts, a record low! On the other hand the last two stock pitches has turned out really really well (so far). I have spent quite a lot of time thinking about how and in what way I should continue this journey.

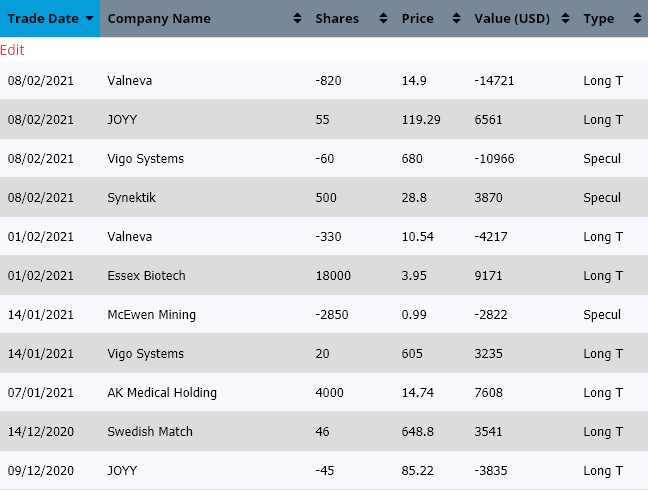

The blog has been a bit unusual in the sense that I have given very high transparency on my positioning and trades done. For a few years you could even search and see each trade done in my portfolio through a small database on a specific tab. The purpose of me starting this blog, was to evaluate if I could beat index investing, have fun and hopefully learn a lot along the way. The blog kept me honest and accountable for what I did. I also had to do the work properly as I could not post a semi finished thought or stock idea, I needed to cover all bases. This has been incredibly rewarding for myself. I look back at my posts from my first few years and feel I developed a lot. I had good intentions back then and I think I put good structures in place. I also got a few big things right, the call on EVs 2016 was great but I did not really have the experience to capitalize fully on it. Avoiding traps and really doing the work on a company was not there back in 2016. That’s something I’m confident I can do now, if I just have the time. Buying into ZimVie late 2022 around 8-9 USD getting a small quick gain and then getting hit with a -40% day, that’s not something I would have had the confidence to handle well 2016. Today I can keep my cool, it’s not my first rodeo losing 40% on a day in a stock. I can think it through rationally and decide. As in this case I decided I’m right and the market is wrong and I will double down at 6 USD per share. I recently took my first profit at 18 USD per share in ZimVie, this decision alone saved my year up 13% instead of another year close to flat returns.

Basically I have fulfilled the purposes I set out back in 2016, now close to 8 years later I’m a significantly better investor and although I invested close to half of my money on the Hong Kong exchange, I have beat the MSCI World (although barely). I have crushed the Hang Seng Index, or just World stocks ex USA for that matter. Ok enough of bragging, I’m still quite unsatisfied with my returns, as I know it could have been so much better with less focus on Hong Kong. So with this in mind it’s time for something new and different. I’m not sure if it will sadden you or not but I will not do anymore portfolio reviews. No more posting of all my holdings. The focus will shift to just discussing ideas, like thematic stuff I posted in the past and specific stock pitches of course. In what format I would do that I have not fully decided, but it will most likely not be in the shape of only as GlobalStockPicking anymore. This blog has been here to document my investment journey and my full portfolio, a fresh start will probably be better for a new format. I will take 2024 to set out a new path and let’s see what I come up with in the future. Stay tuned 🙂