This time around I thought I would take a different approach. Recently I walked through all my current holdings: Short comment on all holdings

Today as a year end evaluation I will do the opposite, go through all companies I held but sold. This will also give new readers who hasn’t read through my blog from the start a better understanding what has built my performance over the years. For every holding, if you want to kno more, check through the drop down menu (if you are in a web browser) and select the stock in question. The purpose of this exercise which took quite some time to compile is to evaluate if I’m turning over my portfolio, too much or too little. And even more importantly of all the investment ideas I put in my portfolio over these years, are they of high quality? Have they kept performing after I sold or am I buying too many poor performing businesses?

All stock performance data is converted into USD and total return (meaning dividends are reinvested) and benchmark against my GSP portfolio. Also take note that the Y-axis varies in scale, let’s get started!

Press “Read More” and be ready for a lot of graphs!

In stock code alphabetic order, all stocks I held but sold:

This company goes back to me following NagaCorp. It’s the only company running a casino in Vladivostok (Russia) where NagaCorp currently is building a casino. I bought this on the anticipation that they would be able to lure a larger number of northern Chinese VIP customers there. For a while it looked like they would succeed with this, but when that did not materialize I sold my shares. Timing wise fairly luckily! I Kept this on my radar to see if VIP business would recover, which it hasn’t really. The casino is not doing awfully but its no home run either.

One of my bets on the Electric Vehicle industry. I thought I was clever that found such a small hidden unknown player, which I initially was and the stock skyrocketed. Luckily I took some profit at peak prices, a bit more unluckily I added on a dip and held my shares when the business started to deteriorate. My thinking here has been to let my original investment thesis play out. What I underestimated was the debt burden the company was under. It was not able to compete with the larger players who had more capital backing. I understood this gradually during 2018 and should have sold then, instead I kept this until fairly recently. Being long term in this case hurt me quite a lot.

This is a company I owned way before I started my blog, a slow in steady high dividend company which owns toll roads in China. Fairly high leverage but also a well run company. I thought I could do better long term than such a slow and steady investment and also did not feel this was worth the “China risk” of holding this. So far it has been neck-on-neck with my total portfolio.

Another one of my Electric Vehicle investments (I was more thematically based investment wise when I started off the blog). Over time I realized that BYD’s cars were pretty bad and I lost conviction in the case. I unfortunately sold half just before an announcement from the Chinese Gov to support EVs even more than previously. I sold my second half in the run up. Lessons learned here were how much China policy drives Chinese stock returns and also let the momentum run until it starts to fade.

One of my deep value cases, tiny company where I have tried to really dig deep to understand the business. Unfortunately this was disrupted by a forced offering of buying out the company, which they did at a very poor level. Me not really knowing if the company would even stay listed decided to sell at the offer, although I was not happy with the price and would have wanted some 20-30% more. Lesson learned, sometimes a strong majority owner can really screw the other investors.

This was another value case where I didn’t exactly the timings of my buy and sells correctly but it still turned out very well. The bigger story here was probably the companies I did not invest in, but which I had as peers in my valuation, Li Ning and Anta. Both these companies have had fantastic stock performance since when I invested in Xtep. I sold Xtep because of poor capital allocation by the management and I don’t consider this to be a well run company. Anta on the other hand seems much more well run, but since it was so much more expensive than Xtep with my growth at a reasonable price approach I choose Xtep. I guess sometimes you should be willing to pay a bit more for better management.

One of two of my funeral stocks, which was a thematic idea I came up with after trying to think a bit outside the box. A fellow blogger did even deeper research than me on the stock and I realized what I bought was not so attractive and decided to sell. This was also related to british Dignity which I will come to further down.

I think I found a face-palm picture to describe how I felt a few months after this sell. A Chinese car sales company which was a speculative holding on my side of something that looked way too cheap. It kept getting cheaper and I concluded I did not understand the company well enough and stop loss out of the position. Conclusion obviously is that even if you just going to do a more speculative short term trade you need to know the company fairly well, which I did not, so I did not have the conviction to keep the stock. To be fair, with Chinese stocks in general its very hard to build that conviction, given the “China Hustle” risk.

Another thematic position was China healthcare which I thought had fantastic long term demographic tailwinds (which it still does). The company I expressed this through was a conglomerate which has it’s fingers in many Chinese healthcare pies. Another aspect of this investment was that there was a cross holding with SinoPharm which has rallied a lot, without Shanghai Fosun stock moving upwards. So there was a value gap there which I thought looked attractive. Again I was fairly quick to take profit, mostly again because of low understanding of the company and it’s revenue drivers going forward. In general this is the issue with more thematic bets, you should really buy a wider group of companies if it’s a thematic bet, otherwise the deep company understanding is essential. And since I want to be a stock picker, I have concluded that thematic bets are fine, but they need to be coupled with deep due diligence at company level.

This is on some measures the worlds largest insurance company. I bought it because I thought it looked unreasonable cheap (which it was) and sold when it had repriced. After I sold the whole story of Ping An being a tech company started to take foothold and the stock re-rated further. Again I was very quick in a strong positive momentum to take profit. Lesson learned has been to sit on my hands longer in a “slow” strong positive trend share price wise.

I have written a lot about this company and it’s actually still in my portfolio. Why is it in this list of graphs then? Well I just wanted to brag a bit and show that not often, but sometimes, I do get timings extremely right. Obviously I should not have sold any shares at all, but at least I re-bought at a very good entry point. I’m still very bullish on this company and stock at these levels, I even visited the casino. Let me know if you want me to write even more about it!

Swedish online brokerage which again was a thematic idea of more tech-savvy companies would eat the big banks retail business over time. This was a theme but also a company I knew well, I sold due to valuation being high, which it still is. I would like to find a lower priced company with a similar profile. I have looked at Interactive brokers and it’s OKish, but also a bit pricey. Another one that recently popped on my radar screen would be German Flatex AG which recently acquired Degiro. Do let me know if you have more insight into Flatex.

This was again thematic, not in the sense that I love tobacco companies, but rather that due to ESG compliance of large investors, this was mercilessly sold off. At least that is my thesis of why to companies became so cheap. I bought both BAT and PM at the time and sold of BAT when I increased my holding in Swedish Match. Not because I did not like BAT, but just didn’t want to be overexposed to a single sector like tobacco.

This is a company which was fairly hyped in the Swedish investor community. I generally hate buying hyped stocks and instead bought it on a big sell-off. I thought I understood the company fairly well, but when digging deeper I realized I do not. Around this time was when I started to be more strict in my due diligence and investment style. I was no longer buying companies I did not feel I fully understood, so for that reason I sold Catena and it happened to be a lucky timing.

I thought I had found yet another super undervalued Chinese stock listed in the US. What I rather found was probably a China hustle stock, which thankfully one of you blog followers pointed out through a short report on the company. I quickly re-assessed my risk reward in this and closed my position. This has so far been the correct decision. Company is still dirt cheap but as is fairly common in hustle companies, performance start to deteriorate which it has done in Cheetah Mobiles case. The name in this case seems to be a tell sign of the company.

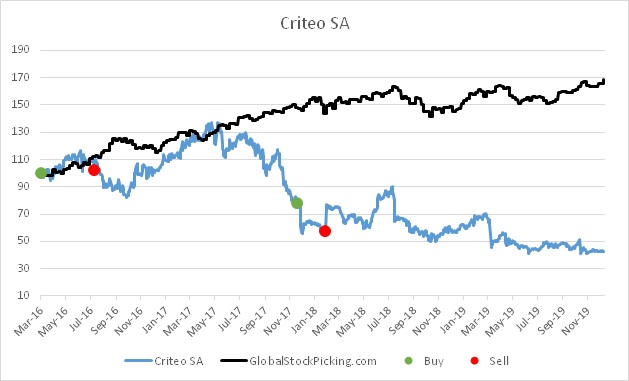

Another one of these companies I thought I understood and later realizing that actually I don’t. I sold somewhat unluckily just before a big stock surge, but overall my decision to sell has been the correct one. This company service companies with internet ads and much of their business has been blocked by the internet giants, like Apple.

A thematic idea I had when the blog started, Chinese people will travel more and this seemed like a well run company. I think both the thesis about travel holds and that its a well run company. The issue is the murdering competition in China tech space. Other larger players have come in and ate Trip’s (or Ctrip as they were called back then) lunch. This is a general lesson learned with China tech investments, things can look very good for a while. But anything someone is very successful in, the competition will pile in like crazy. As a more general point I think this is underestimated among all the “compounder bro’s” out there, with companies growing top-line 30% YoY with zero profits. The idea is that these profits are going to come later when market dominance has been established. My view is that with very few exceptions, there is not going to be a market dominance with fat margins, there will be murdering competition eating up all that nice margin.

This was my second funeral themed investment. Basically I walked into something were I did not understand the local UK market dynamics. My timing was immaculate, I think the stock dropped some 50% 2 days after I bought my shares. I thought it was an over reaction, which it was, until the UK government decided to also squeeze the funeral market, with the intend of protecting UK citizens from increased funeral costs. At that time I sold and have not looked at the stock since. The company is cheap but I don’t dare buying into an industry where the government is out to get you for “shamefully” making money on citizens funerals.

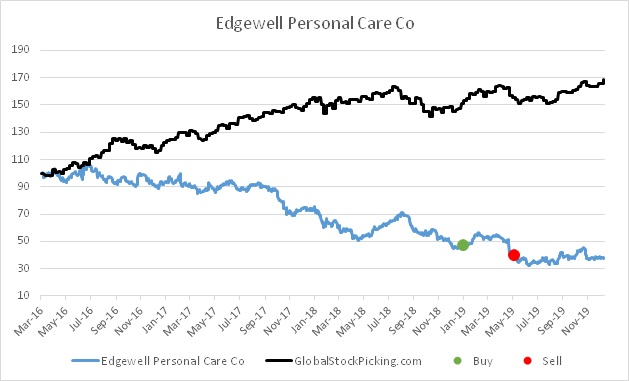

Another value play going wrong, not because my thesis was wrong but because I misjudged the incompetence of the management. They owned great assets, like Hawaiin tropic suncream and Wilkinson Razors, instead of building on these great brands, they panicked. So they overpaid and bought a razor startup for crazy money. I sold my shares directly when reading this. Lesson learned, there can always come a curve-ball at you, no matter how well you read up on the company. I’m still pissed every time I go the supermarket and pick up a set of razor blades.

This was not so much a sale as a switch, into Essity’s Hong Kong listed subsidiary Vinda. Both entities are a play on demographics and in China’s case just in general population which is more well off, consuming more tissue and basic goods. The other part is how strong the company is in incontinence products, which a lot of old people need. China will “soon” have A LOT of old people. This is for the long long term investment bucket.

I wanted exposure to Pharma, I read an excellent deep analysis by a fellow blogger. I liked what I heard, I did not have any better Pharma ideas at the time, so I bought. In hindsight this is a very large company, followed by endless number of investors, it’s highly unlikely I, or my fellow blogger would have an edge information wise in this company. It would then come back to my general thought of markets being to short sighted and as a long term investor you can outsmart the market. That could have been true and the company is still trading at low multiples and generate a lot of cash. I sold since I had given the thesis time to play out, nothing had happened share price wise and in general one has to be humble about the edge you have in large companies. Most likely it is low to none, even with a bit longer investment horizon.

Another of my EV theme plays. This company and stock was all over the place back in 2016/2017. I don’t think I ever fully understood the company and I quite frankly stopped following it after I sold it. Finally it got bought out by management to twice the price as when I sold. Revenue wise the company actually did really well and I should perhaps pick up a bit more on the details of this company, because there is another HK listed entity with a similar profile with a very low valuation. To be continued..

This company makes your paper cup when you buy your daily coffee at Starbucks or similar. It was built on a large number of smaller acquisitions. I sold due to my friend making me aware of trucking rates flying through the roof in the USA (they have come down again) and that I thought the plastic waste discussion would hurt the company (they make plastic straws/cups as well). I was totally right to sell, with a fantastic timing even, but then things reversed and I did not continue to follow the company. It would have been a great entry somewhere close to the bottom of course. But then again, that would been a speculative buy (which I do allow myself to have a few of). My strategy from 2018 on wards has been to find great long term holdings and Huhtamäki did not fully deserve a place for me within that bucket, givens it’s plastic challenges.

This was a defensive dividend case I had when I started to get fairly bearish on the markets in general. Lesson learned again I think is, my edge in buying a large cap companies is usually very low. There was no kind of special circumstances that would make me have an edge to buy this to a discount. Even though the stock performance would have been better, I regret buying this type of company. This was still in the days when I had not clearly defined what type of investments I should make. It’s make me quite happy and content that I feel I developed that much over this past years, much more clearly defining what kind of stocks I should invest in.

This was another opportunistic/speculative buy where I had read up on the company with the purpose if it would fit my long term holdings. I had not fully made up my mind about that when this opportunity to buy this company on the cheap appeared. I was again a bit early, buying straight into the falling knife instead of waiting for the stock to bottom out (another lesson for me). In the end I turned out correct, of course helped by a rebounding market during Q1 of 2019. I decided this was not a long term holding for me and this time managed to hold through the momentum better on the way up. The company today seems to be quite well liked by investors, I see quite a lot of chatter about the company. It’s logistics function it build, which attracted me to the investment in the first place is first class and probably worth quite a lot. News last few weeks is about spinning of the logistics leg in a 8-10bn USD IPO, I think this is driving the stock lately.

Brewery and alcohol related companies is something I identified a long time ago as companies with very good long term track records, just as the tobacco sector. I bought a few stocks here, Olvi, Diageo and the Kopparbergs. The other two I still hold but Kopparbergs was always the tricky one. I spent a lot of time thinking through this case. I visited a lot of shops and looked in a lot of bars around the world (i travel quite a bit) to see what ciders they stock. My conclusion was that Kopparberg was losing out to competition like Sommersby and Swedish cider called Rekorderlig. So I sold, which turned out so far to be the right decision.

This investment was made before everyone had started to understand how much e-commerce would disrupt retail clothing. I’m happy that I was fairly quick to catch up on the issues facing the industry in general and managed to sell before all hell broke lose. Sitting long term in these type of investment is horrible and it destroys so much of a portfolios performance.

Well what can I say here, I should just have put all my money with Bill Gates and gone to sleep, not worrying about picking stocks. It’s somewhat humiliating these last years when an investor that picked a basket of the largest tech companies have outperformed more or less everyone. To find some lesson here I again should be better at following the trend I think, the stock is trending strongly upwards and I should wait for a longer break before I sell, in this case perhaps around Sep-Oct 2018.

A clever investor back in 2015 told me that we might see another nifty fifty market again – he turned out to be entirely correct. The nifty fifty is referring back to the 1960-1970s, when some 50 large caps stocks in the USA got extremely popular. I’m taking some descriptions from Wikipedia from this period in the early 1970’s and see if its sounds familiar to you:

“In the United States, the term Nifty Fifty was an informal designation for fifty popular large-cap stocks on the New York Stock Exchange in the 1960s and 1970s that were widely regarded as solid buy and hold growth stocks, or “Blue-chip” stocks. The stocks were often described as “one-decision”, as they were viewed as extremely stable, even over long periods of time. The most common characteristic by the constituents were solid earnings growth for which these stocks were assigned extraordinary high P/E ratios. Fifty times earnings, far above the long-term market average, was common.”

“The long bear market of the 1970s which began with the 1973–74 stock market crash and lasted until 1982 caused valuations of the nifty fifty to fall to low levels along with the rest of the market, with most of these stocks under-performing the broader market averages. A notable exception was Wal-Mart, the best performing stock on the list, with a 29.65% compounded annualized return over a 29-year period.”

So far I have been wrong and the best way to have outperformed the benchmark would have been to invest into a basket of these type of companies instead of bargain hunting and trying to find value among small caps. I will stick to my guns and let’s see how the coming years turn out.

The stock I traded most frequently on of all my holdings! I have had different thesis over the years with this company, some built on valuation, some built around the founder who I’m very impressed with. In the end what made me sell and give up this company until valuations become truly appealing is again the competition. NetEase being a large company can shy away partly from this competition by releasing blockbuster games, but still, there are so many game developers now, so NetEase should not have such a high valuation (P/E 20 today).

One of my opportunistic trades that I’m most proud of. This was exactly the type of trade where I can excel, understanding the Chinese market and the Nordic markets. The traded related to the defunct HNA company and it played out exactly like I hoped. Some readers of my blog was then more clever than me pointing out I left some money on the table when the bid most likely would be raised. Here I have a bit more to learn in terms of counter-bids, raised bids etc. You were right and I sold a bit too early!

This was a play on Nordic housing and construction market, this being a late cycle more speculative investment. It worked out as planned I exited, later on the company has been acquired which lifted the stock.

I struggled with this small cap company which produces pulp. It was a play on low valuation, weak SEK and high likelihood of improving pulp prices. In the end I sold, because company execution was too poor for my liking. The SEK kept weakening and pulp prices improved, so shareholders that stayed got rewarded and it outperformed my portfolio. But I’m still OK with selling, I need to see that the company is well run otherwise it’s a sell for me, now macro saved the day for investors, but that could also have gone the other way.

Again a holding from the early days of my blog, I would not buy such large caps any longer, but just like Microsoft, it would have been a great stock to just hold on to.

A very short lived holding in my portfolio and the only time I held something which was more like a high yield bond. This was one of very few preference shares that done extremely well in the Swedish market. The performance looks a bit weaker though due to the SEK dropping a lot against USD during these years.

My final EV related investment, which was a French battery company. Just like HPJ it also got bough out, by energy company Total. Unfortunately a very small position in my portfolio at the time.

This was another of my speculative stocks, I had read a lot from a great Spanish investor who was very long these type of tanker stocks. He had lost a lot but was sticking to his guns. I’m no expert on this at all, I just looked at macro fundamentals in terms of tanker rates etc over the long term. It seemed likely that we were close to a turnaround, but it might as well take another 2-3 years, and then this company would most likely been bankrupt (a lot of debt). I didn’t have the guts to hold when nothing happened for a while, so I sold. Just a few months after things took off and now twitter is full of guys pumping this tankers stocks saying they will earn so and so many million dollars per day in profits. It’s a shame I didn’t dare to hold it a bit longer, but I probably would not have held it until today anyway.

Here was an example of a holding where I thought I found a growth at a reasonable price, but it did not really play out as I had hoped. It got stuck in some kind of value trap land and I did not have the patients to hold it. This is also probably something I will need to get better at, just because I bought into the company, it doesn’t mean that the market will wake up and reprice the stock very soon after I bought it. I need to have the conviction to hold the stock long term and the re-valuation will come, sooner or sometimes later. One of few of my deeper analysis that actually got away from me.

Uranium stocks is another favorite among a small group of twitter investors. Me being an investor who participated during the Uranium bull back in 2005-2007 know the sector well. This company is an old friend that made me money back then and was one of very few Uranium juniors that made it all the way to actually producing some yellow cake. Most other just went bust. I think this like the tanker market, it’s going to take off soon, but it might also be another 2-3 years before it does. The kicker here was that USA was going to protect USA/Canada production, which so far does not seem to happen, therefore the stock price crash after I sold. I sold because I re-evaluated the risk reward at the price level the stock was trading, after all this was more speculative for me (at the moment). I think I will keep an eye on this and be ready to jump in if things really get moving.

My latest investment I also add in here, and YY seems to have changed name to JOY! I add the graph since I sold it and had no shares from July 2017 onwards. Again, the lesson here is not so much that I was wrong to sell (the company clearly got overvalued for a while), but that I’m too quick to sell in very positive momentum. The problem I guess at the time was that it barely looked like positive momentum, more like sideways ripple. The trend became more clear after I sold.

Conclusions

- Overall I have held (and sold) very few stocks that significantly outperformed my track record after I sold – that is a big problem. It means either that I’m not finding good enough companies, or companies that the market over these past few years have still not decided to revalue to a level more in line with what I think they are worth. Either way the set of stocks I owned in the past, has been a very difficult set of stocks to outperform the MSCI World benchmark with. Even so I have done just that since inception, but been crushed by MSCI World during 2019.

- Being active and turning around the portfolio has actually saved my performance. Sure I have been looking for great companies to own for the long term, but me trading around positions has significantly added alpha. How much? Well it’s a bit difficult to quantify, but lets look at it in two different ways. Here are all the companies I sold which are still listed:

This does not take holding period into account, but the average time since I sold is about 1 year and 8 months. The total return equal weighted of holding on to all of these stocks instead of selling them has generated only 5% over that time period.

Looking at it another way, if we take the Compound annual rate of return (CARR) of all holdings, that takes the time dimension of the holdings into account:

This will make holdings which I sold recently to show high CARR, since a 15% return in 3 months since I sold will be some 60% in CARR. Again the Average CARR is very poor. Sure I have a few stocks that I should have held on to and they would and significantly helped my performance in the long or short run. But my portfolio has a better CARR than this.

So final conclusion is that I made the right choice almost in every single case to sell these stocks. This is something I need to contemplate more on and I will come back with some follow-ups. Now time for New Years Celebrations – Happy New Year and thank you for following me during 2019!

Please have a write up on your visit to Naga. Not much available online from customer and investor perspective.

Ok! Will try do find some time, most likely will have to wait until Chinese New Year or so.

My quick comment would be it increased my conviction to stay long this stock. Downside risks would be opening of more casinos in the region. Learned of a casino by New World and Suncity which is opening very soon in Da Nang..

It’s been trading sideways towards the end of the year after a massive surge for most of the year.

One thing that a lot of people missed was that it managed to extend its monopoly for a further 10 years for a ridiculously low amount of $12m. I think if you add another zero to that sum, it would still be cheap..

Re competition , after banning of proxy betting and, poor infrastructure and over saturation – I think it would be difficult for anything sihanoukville to compete.

For the rest of asia , clearly a lot of capacity will come online. That’s why it’s important for the moat to still be intact and for Naga to raise it’s game.

Please also visit Vladivostok 🙂 need to know wtf is happening there … Seems management is sand bagging big time until market improves. Summit ascent is now pretty much turning a profit but not massively…

I think they got the extension not due to the 12m but due to the 3.5bn investment in Naga3 🙂

Sihanoukville seems more to be a gangster gambling den and a huge number of live-video tables like Evolution Gaming is running. There has been a huge crackdown recently on the live video tables.

Project delayed due to Chinese constructor defaulting. Vladivostok I do not have on my 2020 vacation schedule 😀

Hi,

As you mentioned flatex – I actually owned the stock last year and just recently decided to sell the remaining..

The reason is that in my opinion the management is very greedy short term which might harm the long term outlook a lot.

While several broker startups are attacking in Germany with zero-fee offers flatex could drive them out off business with better offers. Given their scale advantages they should be still profitable with much lower prices. Instead they raise prices, from march on there will be a 0.1 percent fee on the overall account volume. If I look into forums customers are pissed…

Anyway when I talked to customers even a year ago, they wouldn’t recommend flatex . The general impression is that headline fees look good, but then you have to pay all kinds of hidden extra fees.

Short term earnings might go up a lot, and unit economics look very good. But long term I expect some disappointment as the greedy pricing politics opens opportunities for new market entrants.

Accounting also looks a bit aggressive I have to say, it is hard to compare developments because of segmentation changes, but they seem to activate all the software development and these activations went up and push earnings.

Thanks a lot for your input! Appreciate it!

Something went wrong when I was posting, some 5 stock graphs are missing, among them my biggest landmines like Dignity, I will do a follow up post with some more comments adding in the missing graphs!