It is not every day your largest position get a takeover offer at 40% premium. Surely something to be celebrated – or?

Philip Morris International Inc. (“PMI”), has today announced a public cash offer to Swedish Match’s shareholders, offering SEK 106 per Swedish Match share in cash.

Fantastic for my more than slightly bruised portfolio to get a quick win but long term is this what I want?

A look in the rear-view mirror

Swedish Match (SWMA) entered the portfolio in August 2017 at a fairly modest position size, this is what it looked like back then:

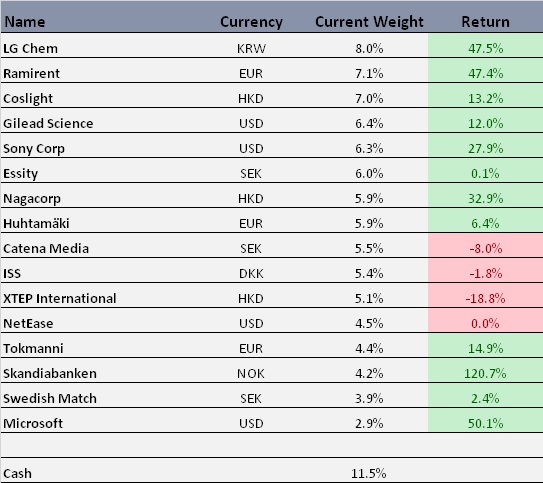

Portfolio in October 2017 when Swedish Match was a new position

Over the years I have slowly doubled my initial position. Although the stock has been a good performer, for a long time my average portfolio actually did better. The difference has been that most other winners have over the year left the portfolio, but Swedish Match always stayed. Only Nagacorp has been there longer. I have been so impressed with how ZYN developed in the US and the defensive characteristics of the company. With that I was happy to keep this as a high conviction position, especially into a overheated market (as I strongly argued in my recent everything is a bubble post). With the money from selling my RaySearch shares, I luckily even re-allocated a little bit of that to Swedish Match just a few weeks back. With the additions over the years, and strong stock performance Swedish Match was my largest holding when the takeover offer came in this week. My portfolio as of Friday (before the offer).

Portfolio as of May 6th 2022

I have a decision to make

Like all shareholders I have a decision to make:

- Sell my shares now, trading at roughly 103.5. In this price there is the risk that the deal breaks which would then be mitigated, I get something guaranteed very close to the offer. But selling at this price also foregoes all call options that the bid would be increased, or another bidder would come in to challenge PMI.

- Wait and accept the offer, that implies a nice cash yield of 2.4% until the money arrives in September. One could argue that I should then even increase my position and put my cash in Swedish Match for a nice yield on cash. That is if I believe there is zero risk that the bid is withdrawn. I would then also enjoy the upside potential that there would be a bidding war.

- Not accept the offer. I come to the conclusion that this is a stink bid and Swedish Match is actually worth more. My hope then is basically enough other investors come to the same conclusion and PMI either fully takes back the offer or buys a so small part (could still be majority owner) so the company stays listed. This is tricky in many ways, because if PMI becomes a majority owner and I’m left with shares in something that now is fairly illiquid and the majority owner wants me out. It could be a long bumpy ride, perhaps something I’m willing to do with a normal sized position but it would be hard with my absolutely largest holding (consider the 12.8% weight above is pre-offer). This makes me conclude there is a 4th option:

- Reduce position size (take partial profit) and not accept offer with smaller position.

Attacking the above one by one:

1. Sell my shares now

In fact I have already sold about 8% of my position on Monday to slightly de-risk, this was before the bid level was confirmed. Further than this I’m not considering this option anymore. I see it as highly unlikely that the offer fully falls through.

2. Wait and accept the offer

For the time being I’m definitely waiting, I think there is a small chance that a competitor or even VC/PE fund will come in with a bid. As as another bid is that a lot of larger shareholders would be in talks with PMI over the coming months, making them understand that the offer will not go through on this level. PMI would then be inclined to increase the offer.

3. Not accept the offer

Even if this is not a stink bid, it’s actually not far from it, why? Because the SEK is weak as hell against the USD now and the bid is in SEK whereas the attractive parts of the business they are buying is USD based sales in USA. The refer to the 40% premium to the share price but this is not at all the case from a USD investors perspective, as I am and PMI are as well.

As you can see from the above graph, if investors were happy with the offer valuation, we had plenty of opportunity to jump off at price levels close to this price during last year. But OK, markets are down since then so surely one can’t expect ATH levels and then a premium on top of that. Well yes you kind of can, because SWMA was not a stock that participated in the growth hype category. This was a stock that was very unloved, who wanted to own a tobacco company in these past years – well basically nobody.

Looking at it from a valuation perspective it looks even worse, since the company keeps perform well. The bid is basically at a mid valuation over the past years. This graph was actually the reason I added to the stock just a few weeks ago, it felt very defensive and trading close to its 10 year lows in terms of EV/EBITDA multiple.

4. Reduce position size and not accept offer with smaller position

Given how tricky this situation is, getting potentially caught in a less liquid stock among a smaller group of disgruntled investors with PMI perhaps owning 60-70% of the shares, the best option might be the last one. De-risk a bit, celebrate the nice gains but actually keep a decent position waiting to be actually properly paid. And what is properly paid then? Well given the synergy values this has for PMI, arguable SWMA should have a higher value than it has for the general market. Given that we historically traded at 19X EV/EBITDA, I would say 20X EV/EBITDA is some type of minimum for not being called a stink bid. Which would imply about 25% higher offer than the current value, so in the range of 130 SEK per share if you use a forward looking EBITDA estimate.

For an actual really attractive premium which I believe most would agree is fair and good we are talking 150 SEK per share. That feels highly unlikely though given the 106 SEK they are offering now, so perhaps if more people feel like me, this bid will actually not be successful after all.

Others do agree its a stink bid

John at Bronte who was kind enough a number of years ago explain his deep insights on the company, does definitely seem to think its a stink bid.

Swedish Match: how not to behave when you are kissed on the dick by a rainbow

Hearing from other informal sources other professional investors do feel the same as John.

That said there are also big players like Capital, who own 10% of SWMA and are large owners also in PMI, given them sitting on dual shares one would guess they are inclined to agree to the offer. It’s a tricky situation indeed.

Conclusion

For the time being I’m keeping my shares, hoping for a better offer. If no such offer comes I might sell some shares close to the offer deadline and probably keep some fighting for a better price together with John and others. All of this could of course change given what the market does. If the market falls 30% in the next few months, this offer will relatively look better and vice versa if markets rally from here. Finally SWMA presented their latest report today and it was incredible to see how they just keep growing and even taking market share with ZYN in the US. This picture gives a pretty nice sneak peek of how Total US could develop over the coming 3 years.

You could also buy MO.

I did own it in the past, the thought has crossed my mind..

The best humble brag I read since a long time…

Interesting takeaway from my post 🙂