Why the dental sector?

I had several sector themes in the past and some of them are still in my portfolio (EV’s, breweries, funeral). My most well covered theme has been Electric Vehicles. It’s time to learn about a new niche segment of the market. Over the past year I have spent a lot of time looking in to many different Pharma/Biotech/Healthcare related companies. Unfortunately it has not yielded in anything I can confidently hold long term. I thought I had an investment case with Teva, which I spent a lot of time researching (Teva – The Perfect Storm in 2 parts) but at the later stages of my analysis I decided not to. The main reason why I in general have such a hard time pulling the trigger on a Health related investment, has been the research pipelines. These Phase I, II & III research pipelines often drives most of the value in these companies. I just feel I never have an edge, in understanding the probability, if a product is going to pass through these stages. In the search for something more understandable but still healthcare related, I ended up with dental care. Although still complex, I think this is a niche which is understandable and therefore for me – more investable.

Some segments and markets in the dental services industry has very attractive investment dynamics. First of all it’s generally very defensive, especially in countries where dental care is government sponsored or part of a health insurance. Second, is demographics and economics, the world is getting older and we also live longer combined with increasing wealth. Old people need dentures and implants, and reaching a certain level of wealth, you start to take care of your teeth in another way. These two factors create a significant long term tailwind for these products. Third, it is a very fragmented market, with custom made products. This creates a very low price transparency for the end customer, it will take a long time before end consumers have proper price comparison, for dental services. In many cases it’s also not needed, given government sponsorship or insurance covering the procedures.

This will be a multi part exploration in understanding the dental sector and the investable players in that space. If any of you readers happens to be a dentist or just have deep knowledge in the sector, please do help out over the coming posts to explain the dynamics of the industry.

The Big Picture

It is very hard to get a good global industry overview. First of all because of scarcity of data, secondly because different sources group different products and services in different ways. I have done my best to pull together a industry overview from a number of sources. Most of the industry data is from 2014-2015.

One can divide everything related to mouth health into two main segments, my focus will be on the first of these two:

- Dental Services – All products and services when you visit the dentist (teeth check-up, tooth filling, dental implants, cosmetic changes, xray, etc).

- Oral Care products – All products and services outside the dental clinic (toothbrush, toothpaste, dental floss, mouthwash, etc). Although a large market, I will leave this segment for now, this series will focus on Dental Services.

Tooth decay (dental caries) is the most widespread chronic disease worldwide and constitutes a major global public health challenge. It is the most common childhood disease, but it affects people of all ages throughout their lifetime. Current data show that untreated decay of permanent teeth has a global prevalence of over 40 percent for all ages combined and is the most prevalent condition out of 291 diseases included in the Global Burden of Disease Study. Another very common disease is periodontitis, which means inflammation of the gums and supporting structure of the teeth. Periodontitis starts with gingivitis, where the first sign is bleeding from the gums. I think many of you have experienced early stages of this, when you are flossing your teeth and the gums start bleeding.

We can also see that teeth is a question of economic background, as people get richer they eat more sugary food and get more tooth decay. But as income rises, more of those teeth gets fixed:

Source: The challenge of oral disease

Dental Service market

The U.S. dental services is today a market of more than a 130bn USD. The European dental market is valued at above 80bn USD. The U.S. dental market is growing at an average growth rate of 5.8% per year since the 1990’s. The European Dental market is a more mixed picture, but on average it is growing at a slower pace of 1-2%. For the Asian region the data is much more scarce. Large countries like China and India has not come nearly as far as the highly developed countries, but growing at significantly higher pace (from low levels).

U.S. Dental Services expenditure

The below picture gives a feeling for when markets are saturated in terms of number of dentist per 1000 population. One can see a pattern of about 0.5-0.8 dentists in developed markets, whereas a country as China has significant growth ahead:

Dental Services explained

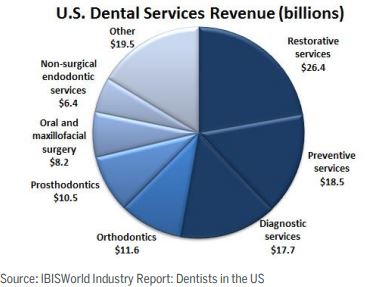

To explain the different parts of the industry I use this split from 2015 on the U.S. Dental Services:

This gives a brief explanation of these different sub segments of dental services

Restorative – Dental fillings, dental crowns, procedures treating damaged or decaying teeth or gums.

Preventive – Routine dental exams, cleanings, fluoride and sealant applications.

Diagnostic – Digital radiography and x-rays, etc.

Orthodontics – Treating improper bites and misaligned teeth.

Prosthodontics – Artificial teeth, partial or full dentures, bridges and implants. This also includes veneers, a thin layer placed over a tooth and other types of tooth restoration.

Oral surgery – reconstructive surgery, jaw alignment, dental extraction. This segment also include cosmetic surgery to the jaw.

Endodontic – Root canal procedures and other treatments related to the pulp of the tooth.

Other – Includes services to dental practices, distributors, software solutions, HR, marketing, financial planning etc.

Within all these areas the are a number of large to medium sized companies providing different products and solutions to the dental clinics. In coming posts I will dive into some of these segments and see what kind of investment opportunities we can find.

Highly Fragmented Market

Dental centers do not normally belong to large chains or a company group. The dental service industry is in fact highly fragmented, with smaller dental shops run by one or a few dentists. The top four dental service firms in the US account for less than 2% of domestic market share, and over 88% of the US dental service companies operate with less than three dentists, according to a IBISWorld Dentist report. The same situation is seen globally in most countries. Some exceptions are: China, where some 350 dental practices control over 50% of the market. This is due to most current centers are government run, in a similar way as hospitals. But as could be seen in the above picture, China is a very under-served market in terms of number of dentists overall. The growth currently seen in China is coming from smaller groups of private centers. In Europe the situation is also mostly of a fragmented market (with Finland perhaps being the exception):

Source: KPMG – The dental chain opportunity

This fragmentation seems to have been something the Private Equity firm have picked up on. Obviously there are synergies to be had by running a larger operation. So from a very fragmented market we have seen the early days of some consolidation. This article (Pan-European dentistry is here, but at what price?) though argues that some players have been overpaying.

This fragmentation in dental clinics has also meant that the bargain power has been sitting with the dental suppliers. These companies are huge in comparison to the small dental clinics and supply the clinics with all the products they need, to run a modern dental clinic. Given this fragmentation on the dental clinics side, most of the investable universe is with these companies supplying the dentist with their products.

Your mouth is expensive

A strong motivational factor for spending on dental care is of course just pure looks. To change the appearance by moving misaligned teeth, using veeners, or just a simple whitening. This is a fast growing segment in the market, where products like Invisalign has grown tremendously. These procedures though are like cosmetic surgery, a luxury product, which will cost you a lot. The Invisalign procedure will cost you anything between US$4000 – Us$8000.

Very few people in the world can afford to out-of-pocket front the full bill for dental care when more advanced procedures are needed. Replacing a lost tooth with a single implant will cost you between US$2000-$6000 depending on where you are in the world. Since dental issues, like a lost tooth seldom is an emergency, we end up with a lot of untreated cases. Because of the high prices, the dental market is to a large extent driven by the level of government support. Few countries has totally free dental care to the whole population though. A rich country like Australia for example seems to have a very lively debate on this, where even young people go with untreated tooth decay: The dental divide – and the decay of public dental services.

Countries like northern Europe which are famous for their welfare states, have free dental care for kids up to around 18 years of age. Even in these countries adults have to pay, although there is still usually some type of back-stop coverage from the state. For example in Sweden 50% is covered between 3000-15 000 SEK and 85% of the amount above 15 000 SEK is covered by the state. This kind of coverage is similar to expensive health insurances in other countries which include dental. For example the health insurance I myself have (global coverage), covers 80% of my dental bills. Even if this sharing of cost helps, people still need to pay out of pocket fairly significant amounts when doing a larger change, like implants or dentures.

So the growth of dental care is very much up to governments willingness to pick up the bill. The other factor is is increasing overall wealth, like in China, where a rising middle-class is deciding to start to pay themselves, either out-of-pocket, or through better health insurances. To reach a larger part of the population, price is obviously an important factor, if companies are able to lower prices, volume will follow.

End of Part 1

I hope this set the stage for a series of posts on dental related companies. Do you have any investment favorites in this market segment and why? Anything you would like to add in terms of important industry trends? Please leave a comment!

What about Dentsply Sirona. They look to have also some integration headaches

Yes I think it’s an interesting case, it’s definitely one of the major players I plan to look closer at.

Awesome stuff! I really enjoy your blog. I ‘m on holiday now and I’m reading Super forecasters:-)

Thanks Bart! How are you fining the book?

I enjoy it very much. I’ve done poker pretty serious a couple of years ago and probabilities play a huge part. As a good poker player you question your performance all the time. Is this play correct or am I result oriented. How am I running good/bad variance wise. I have had very long stretches of playing very good but having bad luck (confirmed with software and post play analysis). I’m almost done with the book but, so maybe it will be touched upon, but which sources you think are more or less reliable in your investment forecasting ? Of course you need to aggregate multiple sources, but for me I still struggle to find good information regarding companies I want to invest in, especially the case for chinese companies. Do you buy industry reports or do you have other sources?

Since I try to look at less well-researched stocks or areas there is usually a challenge with finding good credible data. As a few examples, looking at Tonly Electronics its very hard to find detailed data on who they are producing speakers for and how that sales is going. Even for a wide topic like the dental sector, there is very little available for free that has compiled already something similar that Im trying to write. Left is like you say paid industry reports, for me they are not anyway detailed enough and cost thousands of USD, so I never bought anything like that. One can see that when companies IPO for example in the dental sector, they pay several hundred thousand USD to get the relevant sector overview data, so that approach doesnt work for a private individual when data is scarce. I rely on sell side research for overviews and checking that Im not totally off in my thinking. Also sell side is great at digging out who for example a company is a supplier to, this is never disclosed in annual reports.

But as the book teaches you, even if the government agencies have all the best data, the superforecasters with just a computer and google are able to pull better forecasts, so its not all about data but how you use what you know. Its easy to get stuck in details how the next quarter is going to turn out for a company but in the long run its usually much bigger things which are more easily available that drive returns.

Might want to look at Q&M in Singapore

Yes thank you, already looked briefly at this

Brilliant theme. Had a shallow dive into this sectoe over the weekend. Couldnt find a pureplay I liked. Closest was GHP in Sweden, but Borsveckan ruined that. Great blog!