Recent development

This is the continuation of my post (Teva – Part 1) more than a month ago on Teva Pharmaceutical Industries. At the time the ADR was trading at about 18.5 USD per share. The share price would continue to deteriorate over the coming month down towards a low of 15 USD per share. But a week ago the stock made a huge jump upwards after the new CEO was announced. So before we dive into the valuation, let’s look at recent development.

The 3 billion CEO

As was mentioned Teva has been in a long (and desperate) search for a new CEO. When it finally was announced that Kåre Schultz, the danish drugmaker Lundbeck’s CEO has taken up the position, the Teva share rallied about 20% and increased Teva’s marked cap with about 3bn USD. At the same time Lundbeck saw it’s share drop with -13%, so the value of a CEO can apparently be very big. I suspected a pop the day the CEO was announced, but this was way out of proportion in my oppinion. Showing Teva’s desperate state is the size of Schultz sign on bonus, which all-in amounts to about 44 million USD, with 20m in cash. Nicely done for some who earned the equivalent of $6.1 million in salary and bonus last year!

Looking at what Schultz has accomplished. Schultz comes with a strong track record at Novo Nordisk and lately as Lundbeck CEO where he navigated the company through a difficult period that saw patents expiring for its biggest drugs. He cut about 17 percent of the workforce and oversaw a $480 million restructuring and brought a number of new medicines to the market. Lundbeck is now on track to report record sales and earnings this year and its stock price has almost tripled since Schultz’s appointment.

So this is obviously a big positive for Teva and it increases the probability for a successful execution of their very crucial strategy going forward.

Asset sell-offs

Teva needs to sell assets to meet debt covenants. I have been trying to build an model of future cash-flows over the last few weeks. One of my starting assumptions was around the anticipated asset sell-offs. I spent some time trying to estimate how much Teva would be able to get for it’s “non-core” units. This exercise became less meaningful now, since half of the asset sales already been announced.

Women’s health unit

What has been announced so far, in 2 tranches, is Paragard and the rest of the Global Women’s health portfolio, for a total sales value of 2.48bn USD. Here I have to say that Teva surprised on the upside. In my estimates I had a range for potential sales value of about 3-6x Sales, with me leaning closer to the 3x Sales valuation. But here they got paid close to the 6x range for the whole unit. It seems the Paragard unit which sold for 1.1bn USD with sales of only 168m USD, was worth a lot more than I anticipated. Well done Teva!

Future asset sales

I previously assumed that Teva would want to sell it’s Respiratory business to bring in enough cash, but it seems they got paid enough for the Women’s health unit, to be able to keep it. Which brightens my analysis of the future somewhat. The other unit up for sale is the European Oncology and Pain unit. Again it’s hard to guess on multiples, but sales 2016 was 285m USD and high estimates of valuations has been in the 1bn USD range. So I will assume 1bn and with that sell, in total shaving off a total of 3.5bn on a 35bn USD debt burden.

Valuation discussion

It has not been an easy task to come up with detailed estimate of Teva’s future cash flows. The Generics business is at an infliction point, where margins have been expanding for a number of years for all companies. As with most businesses, when margins gets more attractive, competition moves in. As we will see from my analysis, the million dollar question for Teva’s future is how will margins for Generics products develop over the coming years.

Teva has two main business units

The two main business units are: Generics and Specialty Pharma (meaning mostly pharma under patents). The two units are further split into the following and also a “other” unit:

- Generics (Sales 11,990m)

- US (4,556m)

- Europe (3,563)

- Rest of the World (3,871)

- Specialty Pharma (Sales 8,674m)

- Copaxone (4,223m)

- Other CNS (1,060m)

- Respiratory (1,274m)

- Oncology and Pain (1,139m)

- Women’s Health (458m, now sold)

- Other Specialty (520m)

- Other Revenues (1,239m)

Although Generics Sales is higher, the total Operating Income is slightly higher for Specialty Pharma, given its a higher margin business. In my analysis I try to forecast at least partly on this sub-level.

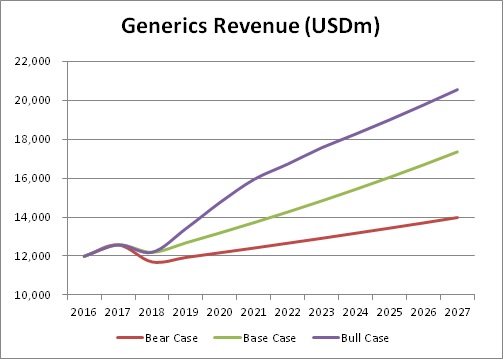

Assumptions – Future Generics market is the key

I quite quickly realized that valuing Teva is about understanding how the Generics market will look like in the future. Up until now Teva has managed to substantially increase its margins on Generics, so has also other companies, like Actavis that Teva bought. With margins now decreasing, both due to pricing power of major buyers (See link) in the US, as well as increased competition from Indian and Chinese players, the investment case might look very different. One the other hand, the sales volumes of generics seems to have a continuously bright future. Generics sales have exploded over the last decade, but with more big drugs falling out of the patent cliff as well as countries pushing for usage of generic alternatives to lower costs, it seems plausible that growth continue at an above market rate.

The more I read about Generics, it looks like any other maturing market with limited barriers to entry. Volumes go up, margins come down and left are the largest most skillful players who can use its scale to out-compete smaller players. So what is left to find out is if Teva is one of those players, has the market in its panic priced Teva way too low, even if what is left is a lower margin business but with good volume growth over the coming 10 years.

Assumption Details

Given that Teva is such a huge company, it’s very hard to accurately model each units future cash-flows but hitting the right assumptions for revenue and margin. I have focused on the broad picture and spent most of the time trying to get the figures right for Generics and Copaxone. It would be too lengthy to go into all the assumptions on margin deterioration and sales.

- For both business units when calculating margins, R&D, Selling & Marketing and General & Admin expenses has been added into the cost structure. For a bull case, more synergy effects from the merger have been assumed than in the bear case.

- Discount rate in Bear Case 10%, Base Case 9% and Bull Case 8%. 1% change in discount rate, changes valuation by about 2-3 USD per share.

- 31.5bn USD debt assumed

Copaxone and other Specialty Pharma

Copaxone is a case about it’s patent expiring on it’s 40 mg drug. It’s not so much a question if the patent will expire, but just how soon, and how quickly generics will take over the market. Here are my assumptions on Specialty Pharma:

Generics Markets

Teva does not specify how much of the recent margin deterioration in Generics is affecting the different regions. But since Teva still produces Actavis Sales numbers separately, together with total sales numbers, one can back out, at least an approximate Sales deterioration per region. The Sales deterioration is not due to less sold drugs in volume, but due to margins shrinking so quick that top line decreases. What is not really mentioned by Teva is that “Rest of the World” margins and revenue is suffering even worse than the US market, while Europe is seeing more of a mild margin deterioration. I therefore make different revenue decrease assumptions for the different regions. Unfortunately Teva does not produce Generics margins for the regions, so only Sales numbers are modeled with such detail. I have used what I can find in terms of short term and long term forecasts for the generics market.

Total

The Total becomes mainly a combined effect of Copaxone income falling off a cliff and the future for the Generics market:

Other costs

Teva is very good to hide costs and show PowerPoint presentations with very hyped up figures, showing figures excluding for example Legal settlement costs, which is more or less a re-occurring item every year. So on top of the business units Operating Income above I have afterwards deducted legal and settlement fees of 500m USD per year.

The issue with leverage

Naturally with leverage the company becomes more risky, how much more risky is really shown in a DCF of the above cash-flows. I value the company including it’s assumed remaining debt of 31.5bn USD, meaning NPV of Cashflows has to be larger than the debt, to give a positive value to equity. This is of-course does not become a realistic case close to zero equity value. Since an option value kicks in, the option that the companies future cash flows will improve.

But this leverage also makes it more easy to understand why some analyst has a buy recommendation with a target price 100% above current market price and others come to the conclusion it’s still a sell. The difference in assumptions is actually not that large.

Valuation results

Bear Case

The bear case gives a negative equity value of about -2 USD per share, accounting for option value and dilution, the value per share is set 3 USD.

The meaning of this result would be there is only option value left (as described above). It also gives an indication of how hard it will be for Teva to service it’s debt, especially if funding costs goes up for the company (which it will, when cash flow deteriorates). If funding cost reaches 10% as the WACC in my DCF, then the company really can’t service it’s debt anymore on the cash flow it generates. There is really a non negligible probability for the company defaulting, then one can argue that the Israeli state would never allow that, and that it probably true. The bear case anyhow, indicates a share price with possible future share dilution in the low single digits.

I would give this cash-flow scenario a probability of about 20%

Base Case

The Base case gives a share price of 14 USD per share.

I have done my best to try to estimate a realistic base case scenario for Teva, short-term and long-term. Against the Base case Teva currently is slightly over-valued and before the CEO announcement was fairly valued. The panic pricing I had anticipated before my analysis rather came out as being in-line with my base case.

I would give this cash-flow scenario a probability of about 60%

Bull Case

The bull case gives a share price of 43 USD per share.

Here the company manages to execute on all it promises and also very optimistically margins of its Generics business improves again in 2018 and onwards. On a gross margin level, they will still slightly decrease from the best levels seen, but thanks to synergy effects, the operating margins come out very good. Also Copaxone generics versions will be delayed by a couple of years. I have found only one example of a generics company that lately managed to keep its margins fairly stable and that is Perrigo, but they still state they expect weakening going forward (Perrigo surprises). So the expectation of a quick turn-around in margins is very optimistic and rather a blue sky scenario in that sense, rather than a very realistic bull case

I would give this cash-flow scenario a probability of about 20%. I think the CEO hire has taken this probability from 10% to 20%.

Summary

Weighted valuation: 20% * 3 USD + 60% * 14 USD + 20% * 43 USD = 17.6 USD, which is 10 cents from where it is trading at this moment.

To be able to buy the stock, either the stock price needs to go lower, or the probability for the bull case needs to go higher. As soon as the market sees that generic margins are not turning as bad as expected, the stock has as we can see great potential. This explosive share price potential is of course due to Teva’s very heavy leverage. But this kind of leveraged bet on the generics market is not anything I’m willing to do without a serious margin of safety. I would not be comfortable to buy the Teva stock before we see almost a single digit stock price. Therefor my recommendation right now is wait and see. Most likely they will deliver another larger good-will write-down during next year, since the cash-flow the Actavis division is generating is nowhere near what they paid for it (they need to shave off probably another 8-10bn USD). Since Teva is such a large and complex company, this analysis has taken a lot of time from researching other interesting stocks, so somewhat frustrating to come to the this conclusion, which was somewhat surprising to me.

As always, any comments are highly appreciated.

Good report! but I have an alternative valuation.

I think that in this specific case, we have to make a DCF from the next year. You can assume a net debt of 28b:

“Let me address your first question on cash flow guidance. You have seen that our guidance on cash flow from operations is $4.4 billion to $4.7 billion. When we look at free cash flow, we use a definition that includes the proceeds from the divestitures. Assuming that we are able to complete the divestitures, as mentioned by Yitzhak, we feel that we will still be in the range that we originally had published of over $6 billion. Of course, that will be subject to the timing of all the necessary approvals and does face a little bit of a crossover risk between the end of Q4 and beginning of 2018. In any case, we feel it will help us on our path towards deleveraging and help us to pay down the $5 billion of debt that we’ve promised in the past.”

This is from last earnings conference call and only includes 2b from Women’s health unit. But now, we know that it is really sold by 2.5b, so you can assume 28bn of net debt for 2018.

I think that you can assume a stabilization on 2H2018- 2019 and a FCF of 3bn for 2018. I am not sure if they could achieve that FCF in 2018, but I´m pretty sure that is plausible in 2019.

If you have this assumptions, I think that 6x Market cap/ FCF and 15x EV/FCF are not an expensive multiples and with business stabilization, some cost reduction from Kåre Schultz and carrying on of debt reduction, makes Teva a good buy in the middle term.

Thanks Gabriel.

Yes one can go with their guidance, but I choose to not fully believe in it. Maybe they get the debt down a billion lower than what I have in my analysis, it does not make a big difference. The biggest difference is what is happening to the margins in the Generic market long-term. If someone has really deep insight into this that would be greatly appreciated. Maybe I didn’t expand on this enough, but basically what I found is that Indian and Chinese competition has stepped in, as is usually the case for all commoditized easy to copy products. This is putting pressure on margins, as well as stronger buying power from Wall-Mart etc. I don’t see any easy turnaround of this situation. What Teva can do is increase efficiency, that’s about it.

In their free cash flow guidance Tevay never add in these very re-occurring items like legal fees etc in their guidance. But they keep showing up every year, because they have to fight their patents and fight for their generics or some mis-treated patients from their previous drugs, that is just part of business.

Yes. I agree with you. It is difficult to predict the margins for the next years. But you have to remember that the generic market are going to have a healthy growth for the next years because aging population, the increasing prevalence of chronic diseases, increased spending on pharmaceuticals in emerging markets… and Teva is the most big player in the sector with big economies of scale. We could expect margin stabilization for 2019.

I think that with the new CEO, they are going to increase efficiency and the future reduction of the debt lead to an increase of FCF and EPS.

And you have to value the market sentiment. I´ve seen the broker´s numbers about Teva and they have too much pessimistic vision about the company. I think that you can achieve 40-50% upside until 2020, what makes approximately 11.8%-14.5% CARG.

This case remind to me to Novo Nordisk, position that I have too in my fund:

http://www.morningstar.es/es/funds/snapshot/snapshot.aspx?id=F00000Y8A6

Thanks for the Teva breakdown, this kind of leverage situations are like a doubled edged sword.

“this analysis has taken a lot of time from researching other interesting stocks, so somewhat frustrating to come to the this conclusion”

Hehe I know that feeling too well (but rather in science work related stuff).

I agree with Gabriel about the overall growth prospects for the sector, and sure, a margin stabilization might occur, but is that really enough? To me it seems unlikely that the margins would start to rise, the indian companies flood the markets and FDA stance of faster and more aggressive approval of drugs (including generics that have few competitors: https://www.bloomberg.com/news/articles/2017-06-05/drug-prices-become-target-for-fda-as-chief-expands-agency-s-view), will really not turn down the heat from competition. I think generics are doomed for lower margins ahead. It’s simply to easy to copy and manufacture small molecule drugs, biosimilars might be another story.

I think that Teva only need a margin stabilization to have a 40-50% upside. If my numbers are correct, Teva could achieve $5.811 bn of EBITDA and 3.30 EPS next year. this means that Teva will be at 8x EV/EBITDA and 5.30x PE.

If they can stabilize their margins, with the growth prospects for the sector, I think that 40-50% of upside is a must.

Have you been watched Siemens Gamesa?