Although I find it highly interesting with Macro analysis, I deliberately write less about such topics on this blog. I want this blog to be focused on stock picking and the struggles of portfolio management. That said, given how many investment I have with a majority of their revenue exposed to Asia/China/Hong Kong I guess it’s time to write down some thoughts on what is going on in the region. The ground is moving very quickly around the Coronavirus (2019-nCov) and the attention has grown a lot over just the last few weeks. Even so I think people living in China & HK vs rest of world have very different views on the situation. I do not pretend to have the answers of what is going but I want to share my view and what I see and hear from people who I know live on the ground. In the end of the post I will go through why I’m as of Friday sold my full holding in Union Medical Healthcare.

The situation from my perspective

I would like to start of by saying, that I think we are facing an extremely serious virus spread. It’s the sneaky feature of the virus that it can spread before people feel sick, which really makes this so very dangerous. Thanks to very powerful actions taken in China and elsewhere, we might just dodge a major major global health crisis.

When the contagion started a lot of people where quick to comment, and in some cases I also drew conclusions too quickly. If you followed this virus situation closely you might recognize comments such as:

- It’s only old or with previous health issues that passes away from this.

- The mortality rate is only around 2%.

- A normal seasonal flu in the USA kills 10x as many every year as this flu, you don’t see widespread panic from that.

- More people die from road accidents in China, since people now stay at home, road accidents should be down, meaning total deaths is down. What’s the big deal?

All these comments have some merit, but let’s look at the one by one.

“It’s only old or with previous health issues that passes away from this.”

It’s easy to understand why such comments came in the first few weeks of the spread. Because naturally weaker individuals would perish more quickly to the virus. A stronger individual would naturally fight the virus longer, even though in the end they might lose the fight. So it is interesting to look at is how many of the identified cases have fully recovered. The count changes hour by hour, but right now there is 37,566 confirmed cases and 2,152 recovered. That is 5.7% has so far recovered, which in itself does not say anything about how many will make it through to the other side. But at least it is clear it takes a person a long time to be rid of the disease. One of the whistleblowers of the virus, Dr Li Wenliang only became 34 years old when he recently passed away due to the virus. According to reports he started coughing on January 10th, but was only a confirmed case on January 30th. It took him almost a full month from starting to cough to actually passing away from the disease. That brings us to the next statement.

“The mortality rate is only around 2%”

I’m not the first one to point this out, but I’m more or less repeating what a lot of people have been saying. You can not take the current 813 dead and divide with the confirmed cases 37,566. Yes this division gives 2.1% but is faulty on so many levels. First of all, like was described in the case of Dr Li Wenliang, who had worked with this from the start. Although he started coughing on Jan 10th, it took another 20 days before he was a confirmed case. The procedure to be tested and confirmed for Corona is not uncomplicated and there is not endless resources to perform this test on request from the public. My best guess is that the test is restricted to really sick people that show most of the symptoms already (fever, short of breath, etc). Again, same with the death figure, this is only confirmed cases that pass away in the hospital. Most likely there will be many that tried to fight through this at home and also passed away at home, never identified as a corona case, but actually was one. So both figures are probably higher. My best guess again is that the actual confirmed case figure is much much higher than the 37,566 figure we see. The death figure is probably also higher, but not by as much. The third and maybe most important factor is that even though every single case of corona infection and death was accounted for you still can’t divide one with the other, due to the timing lag. A person that got sick today, naturally will not pass away on the first day, he will still be a confirmed case though, that might pass away in a few weeks. So how long a lag should we apply? Well again nobody knows, but from the case of Dr Li Wenliang it took him almost a month to pass away, but only a week from that he was a confirmed case. China also classifies how many of the confirmed cases are severe, where one can presume that the death rate will be much higher, that stands at some 14%. Taking all these factors together, you end up with a big range of guesstimates. My own guess is that the mortality rate most likely is above 4% and hopefully not higher than 10%, if I have to say a figure, I would guess 6%. That’s a pretty big span and also a much more scary figure than 2%.

“A normal seasonal flu in the USA kills 10x as many every year as this flu, you don’t see widespread panic from that.”

Yes it might kill more, but there are a lot of factors explaining why there is not a widespread panic from such a disease. First of all, there are vaccines against seasonal flu for the ones that do feel worried. Second, as soon as we step out of bed we are facing risks to our life. As long those risks are very small we seem to be able to brush them off as nothing to worry about. The seasonal flu according to CDC data has a mortality rate of 0.05%. Since a lot of people get the flu, the number of dead will be high during a season. Another podcast I listened to described this in another way. Everyday there are many many roads accidents around the world where people die. Very seldom these accidents even make news headlines. But every-time a plane crashes from the sky and all people on the plane die, it makes news headlines all around the world. This virus has the impact of a plane crash on peoples feelings. The problem is that the virus cases are like planes that keep crashing every day and the news media keeps pumping stories.

“More people die from road accidents in China, since people now stay at home, road accidents should be down, meaning total deaths is down. What’s the big deal?”

The big deals is how people perceive this danger and the actions they take due to this fear. In the end it actually doesn’t matter, from an economical perspective, if the mortality rate is 1% or 10%. It’s the actions the population takes in fear of the disease that matters. Social media plays a big role in this. Panic and fear especially with the help of mobile phones and social media spreads like wildfire. The actions people taken is what I would like to focus on now, because in the end that is what matters.

Situation in China and Hong Kong?

When I started to write on this post a few days ago I felt my fellow investors in the US and Europe had not understood what is going on in China. But just over the past few days I think investors are getting input from company management and decent news reporting on what is actually going on. I felt all worked up, how could equity markets continue up when 1.4 billion people had decided to sit at home, not work and basically tend to basic needs!?

We humans are pretty easy to scare and what influences most of all, is the behavior of the people around us. People can be calm and rational about the likelihood of catching the virus, but change mindset very quickly when put with a new group of people that act more panicked about the virus spread. It’s very quick back to basics in situations like this, Maslow’s pyramid comes to mind. Nobody is any longer thinking about which Hermes bag or new car to buy, when you are fighting at the local supermarket for the last rolls of toilet paper. Maybe it sounds like a joke, but this has been the actual situation in Singapore and Hong Kong over the last few days. People are so scared that they have started to hoard goods like toilet paper, rice, cooking oil. Let’s not even talk about facial masks and hand sanitizing soaps etc. This is a highly sought after good that even if you are rich, you might not be able to source. People in Hong Kong are scarred by the SARS days and takes this extremely seriously, almost everyone is avoiding gatherings by now. People more or less mostly stay at home and most companies apply work from home. On top of that both Hong Kong and Singapore has now effectively shut their borders for Chinese coming into the country. This is obviously very bad for local business, especially for Hong Kong who has suffered tremendously already on back of the protest movement that lasted since last summer. I believe Hong Kong will see a massive wave of lay-offs very soon and with a city with very poor social security, this is going to be extremely tough on a already frustrated population. But, what happens in Hong Kong and Singapore, is still fairly irrelevant for the world economy, what matters is what is that big population in China up to.

China is a big place, so it’s always hard to generalize what is happening. As far as I have been able to gather, the mainland Chinese are either isolated and quarantined in the worst hit areas, or they are voluntarily quarantined in the sense that they barely go out-doors. Partly because they are scared of being infected, but also because they are told by their government to take this seriously and help minimize the spread of the disease. For example you are not allowed to travel on public transportation without a mask in the major cities. So due to Chinese New Year (CNY) holidays, the whole country has been shut since Friday, Jan 24th. A longer CNY break is still fairly common in a normal year, especially for factories. The situation from a work activity perspective is not that extreme compared to a normal year. It would be the services sector (which has grown big in the past years) which has operated at a minimum activity level this past week. The really crucial period will be the next two weeks. China can’t afford to have people just sitting at home another two weeks, it would just have too big economic consequences. At the same time sending everyone back to work, risks severely worsen the virus spread. There is some serious anger in the Chinese society after Dr Li Wenliang passed away, so there are even political stability angle for the Party to consider. A highly sensitive situation indeed. The largest aspect though is the psychological part, reports come in of restaurants being empty or just closed. Home food delivery which is huge now is reporting some 50% drops in deliveries, because people are afraid of contamination just from meeting the food delivery guy. A population which is that scared, will not turn around in a few weeks and buy plane tickets, or go out shopping for a new car. It’s really back to basics in China.

Implications

So my take is that the Chinese population is taking this super seriously, on a government and individual level. Since everyone is taking this so seriously I think we will see long lasting effects on the Chinese economy, with spill over effects on other economies. I see it as wishful thinking that the virus spread would disappear anytime soon, a vaccine takes too long to develop. So we are looking at the virus being around for at least a few months and during that time the Chinese will be very careful spenders. Very few will buy a car, with all the knock on effects to suppliers and sub-suppliers that implies. Very few will invest in real estate, so property prices might turn soft, which is fueling most of the private individuals wealth. Extremely few will travel. I think much of this might stay true even for a few months after the virus seems to really dropped off in new cases. So when 1.4 billion people, more than Europe and USA’s population combined suddenly tightens the belt and stop consuming, could that trigger something else? Perhaps the world has for the past few years, during a epic never before seen bull run for both equities and bonds, built up excesses and made stupid investment decisions during a low interest rate environment? With a Private Equity bubble lurking, and easy leveraged loan money available everywhere? What happens to all this when we get an external shock that significantly slows down the economic wheels? I really don’t understand why we are 1% off all time high the S&P500 when we are staring this situation right in the eye.

The Chinese consumer is today just too big of a part of the economical wheels that are spinning. As Ray Dalio so nicely explains in videos. One persons spending – is another persons income. And when the Chinese are not spending, this is going to hurt the income of a lot of people. In a worst case scenario this could trigger the end of the bull market we have seen.

I want to end on a positive note, about something which I have not seen written about anywhere. I’m convinced China will see a small mini-boom in childbirths in about 9 months time. Remember where you read it first!

My holdings majorly affected by the virus situation:

In order of trickiness to handle

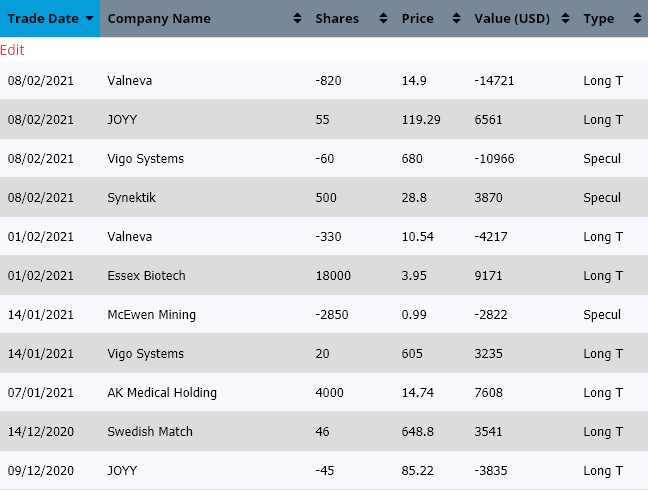

JOYY (a.k.a YY)

The companies cash cow is live streaming in China. With the whole population sitting at home with very little to do, I think this might be one of very few significant winners on this short term. I don’t really get it why the company is not trading up stronger. I have to consider if I should add to this holding.

Vinda

This is the toilet paper producer which everyone is rushing to clean out the shelf’s off. The stock price has probably somewhat stupidly moved upwards due to this. I mean people are just moving consumption in time, the paper they stock piled will mean less consumption in the future. Perhaps this can have some inventory positive effects for Vinda, and the company for sure will have another monster quarter in Q1. But long-term it doesn’t change the case much, it’s also not that overvalued right now that I would take the opportunity to sell. I rather think that long term there is still upside at these levels.

Dream International

Again this toy producer is a winner when China is in trouble, with most of its factories in Vietnam they will be able to run at full steam, whereas the competitors mostly have their factories in China. The company does also have a few production lines left in China, so the company is not totally unaffected. The stock price is stuck in value trap land though, eagerly awaiting my semi-annual report and let’s see what that says!

NagaCorp

Some 50% of customers and even more of the profit for the Nagaworld casino comes from Mainland Chinese, which is still less than Macau, where that figure is over 90%. Even non Chinese customers will probably be much more hesitant to travel to Cambodia during these times. I expect Nagacorp to take a significant short term hit from this just like any business dependent on Chinese and in this case even travel. But the stock has also taken a significant beating lately. One has to weigh the short term loss of income against the strong prospects the casino has over the long term. I have taken the bet that gamblers will be back at the Casino in full swing by summer and that the stock price already discounted a bad period up until then. I might very well be wrong and the market continues to hammer Nagacorp down, my strategy will still be then to weather through it.

Tianneng Power

This was a speculative holding, which performed fantastically until the virus fears shot down the stock. Obviously this is terrible for a producer of batteries in China. They might have trouble with their factories and there will for sure be less sales/replacements of electric scooter batteries when people are not even driving their scooters. Not really sure how to do here, I think I need a bit more time if I should close this speculative position. The case is much less clear than it was a month ago, that is for sure.

Union Medical Healthcare

I thought a lot about this holding lately. A lot of their business is built on Mainland Chinese coming to Hong Kong for different type of treatments, for health, minimal invasive procedures, etc. Lately they expanded more towards actual doctor clinics. Since the protest got violent in October, there are barely no mainlanders coming to HK and by now, with the border shut, there will be zero, for quite some time probably. On top of that due the shortage of facial mask, private clinics are even struggling to stay open. Locals population is neither for sure focusing on these type of activities now. So just like Nagacorp, UMH will most likely see a deep dive of it’s revenue and profits. I still like the founder, but this is just too much headwind for too long of a time. I have to be a bit tactical here and even if I like the company, I most likely will be able to get in cheaper in the future. I’m actually baffled that the stock is holding up so well. I have to be humble that I have misunderstood the situation and maybe the business is less dependent on mainlanders than I have understood. But I decide to sell my full holding as of Friday’s close.

Dairy Farm

This is another one of these which has got everything going against them, since the protest started. First it was the mainlanders that stopped coming during protests, which hurts the Mannings business. Then it was the protesters who got angry with the Maxim’s family, so nobody is eating at their restaurants. Then the 7-Elevens of course in general gets hit by less tourists and people moving about in the city. Now the virus. Well the only thing that finally must be flying is the supermarket business in Hong Kong. I can’t imagine a better market than these past months. People in general stay at home much more since the protests and obviously buys their goods from the supermarkets instead of going out eating. Problem is that I think the losses will be so severe in the other areas, so a great quarter or half year for the supermarket business won’t hold up the rest. In the long run this matters less, what matters is, will Hong Kong go back to normal long term and will the (not so) new CEO turn around the rest of South East Asia? This is not a high conviction position for me anymore and I need a bit more time to decide if it should perhaps leave the portfolio entirely. l have already reduced it to a very small position and the stock price is already hammered.