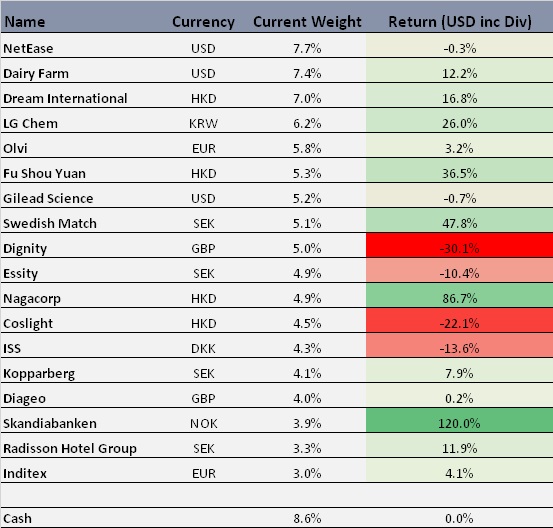

This is my current portfolio snapped as of yesterday, I will make a short comment on each holding, starting from the top.

Category: Portfolio Holdings

Portfolio update and larger portfolio change

2019 has been the toughest year for the GlobalStockPicking portfolio in terms of under-performing against the MSCI World benchmark, YTD the return stand at 3% vs 15% for MSCI World. I did very well up until about April this year, when I posted about a new all time high for the portfolio. Such boasting was immediately punished with severe under-performance. Both US and European markets have performed well, whereas Asia is more in line with my portfolio. With quite a lot of Asia exposure the portfolio has fallen behind, but even taken that into account I have under-performed.

Obviously I’m disappointed, but more so I have been scratching my head. Is this how it should look like at a market peak, as irrational investors pile into Beyond Meat like investments and rational investors fall behind? Or am I on the wrong track and investing in poor value trap companies etc? Before going further into that topic, below is the return in a more digestible format:

Two portfolio “issues”

- First “issue”, I’m sitting on a few Hong Kong small cap investments which are pretty much dead in the water. The market sentiment in Hong Kong currently is not very good and although my companies (thinking foremost of Tonly Electronics, Modern Dental Group and Dream International) seem to have little exposure to trade tariffs (for Dream it’s actually a positive) or exposure to Hong Kong protests, the stocks are not moving. These three holdings at 17% of my portfolio seem to be pretty much in value trap land at the moment. Sure they might be cheap, but there is no interest in the market to price these stocks at higher multiples. So is this an issue then? Well yes and no, if it’s important to keep measuring yourself against a benchmark which keeps moving upwards, then it is an issue. If you are long-term and the underlying businesses are doing all right, it’s a non-issue, at some point the market will wake up and revalue the companies. Given that I want to be very long term, I have decided that this is not an issue for me. Obviously that might change when the semi-annuals soon are released for this companies.

- I’m having too many large cap companies in my portfolio where I have no reasonable edge against the market. Not having an edge on the market is something I thought a lot about lately and something I realized is critical for long term out-performance. I see two main cases (there might be others) where I think I could still have an edge in large caps:

- That I have a much longer investment horizon than the market (my investment in Diageo, Inditex,, Essity, Dairy Farm and LG Chem are based on this).

- Irrational selling flows in certain market segments, for example Hong Kong listed stocks right now, or stocks not fitting into the ESG portfolios which seems to go into everything right now (my investments in Swedish Match, BATS and Philip Morris are based on this).

Basically this gives me a few large cap holdings which have not really been bought with these “edges” in mind: NetEase, Gilead Science and partly NagaCorp. But NagaCorp being a Cambodian investment, listed in Hong Kong and after a big run-up trades around 6bn USD in MCAP. I would say it’s not really a main stream large cap investment just yet.

Portfolio Changes

Selling Gilead Science

Already back when I invested in Gilead I “confessed” that I had struggled to find a really great Pharma investment case. I relied heavily on other investors and their analysis when I invested in Gilead (Another Portfolio change Aug 2017). I think shows a bit how my investment style has changed since then. Today I would not do such an investment without doing my own due diligence a bit deeper first. Given the “no edge” argument, it’s time to let this one go and invest in something where I think I found an undervalued company, which the whole market is not aware of.

Selling British American Tobacco (BATS)

I might be right that ESG tilts in portfolios have put tobacco stocks on the no-go list of investments, but I can’t just base such a large portion of my portfolio just on this. I need to see that these companies long term are capable of delivering great returns in my portfolio. Swedish Match I think qualifies there, that’s why I increased my position there. Philip Morris might qualify long term, I do like the IQOS product and long term it’s success will be pretty crucial for delivering really strong shareholder returns. In BATS case, I’m pretty confident that this is a good defensive company which will deliver decent shareholder returns, if I was a corporate bond investor I would like BATS quite a lot. But I’m looking for slightly higher returns and I gambled a bit too much on this ESG angle having 3 tobacco companies in the portfolio, two is enough and BATS is the weakest link.

Selling Essity and switching into it’s subsidiary Vinda

This switch is something I haven’t mentioned, but looked at for a long time now. Vinda being a Chinese tissue paper products producer, majority owned by Essity and listed in Hong Kong. Basically the case is that given demographics, Vinda will see much stronger growth than the rest of Essity, which is also confirmed in historical results. So all else equal given higher growth Vinda should trade at a higher multiple, but it’s rather trading just in line with Essity. Why? Probably because Vinda being somewhat illiquid in comparison with a small float of some 25% on 2.2bn USD MCAP. But you get a Swedish governance run company, with full exposure to China’s growing middle-class and elderly population. This is truly something to put in the long term bucket.

Some pictures showing how Essity and Vinda traded since Essity got listed as a separate entity (spun out from SCA):

I was unfortunately asleep at the wheel during the summer when the spread was at it’s largest. The spread shrunk after great H1 results from Vinda, but has increased again on back of Hong Kong stocks under-performing in general (probably due to protests etc). So this gave me another opportunity to switch into Vinda.

Initiate new position in AK Medical Holdings

Another twitter inspired holding (LiveChat being the other), which I feel a bit ashamed of not having found myself (given how much time I spend looking for stocks on the HK exchange). Again my timing here is not the best given that the stock has rallied quite a lot recently. A full write-up will have to wait, but this is the holding I hinted at in my 3-D printing post. The company produces orthopedic implants, mainly for the hip and knees. The sell their products almost exclusively in China. Over the last few years the spent quite a lot of resources to use 3D-printing technology to create better custom made hip implants. Just as I wrote about in the 3D-printing post, the most successful examples of 3D-printing so far has been for the human body, where the need for customization is high. The companies sales of 3D-printed implant parts is still fairly small compared to total revenue, but it’s growing very nicely. It also shows the companies ambition to not just be the low cost option for implants compared to international players.

I think the company partly have traded so strong lately due to trade war speculation. If the trade war intensifies, probably international companies selling hip implants will face difficulties, which could favor a local player like AK Medical. My investment thesis is not based on this though, although of course it’s nice to have a trade war hedge in the portfolio.

This company is not trading at very cheap levels, so I will start with a fairly small position. You will have to wait a while longer for a full write-up.

Sizing and adding in Sbanken

I sell the full holdings in Gilead Science, BATS and Essity as of close Friday. This takes my cash level to about 14.1%. Of this I allocate a 5% to Vinda and a 3% position to AK Medical Holdings. Of the cash left I decided to increase my position in Sbanken again, which has traded down significantly on general Nordic bank stock weakness. I take my Sbanken position back to 5% of the portfolio, leaving a small cash buffer.

Follow-up on portfolio changes

This is a follow up post of my recent portfolio changes. Below is my current portfolio, now fully invested, no cash. As always you find this picture on my portfolio tab. Another small push of about 0.5% is needed for the portfolio to take a new all time high.

Below follow my thinking on the portfolio changes I made:

2018 Summary and Review

For 2018, the Global Stock Picking portfolio is down -2.5%, that compares to MSCI World Total Return (i.e. including dividends) down -8.2% on the year. My return is also including dividends but no trading fees deducted. In the counterbalance to fees, I do not calculate any return on cash, which has averaged around 9% of my portfolio. Given my fairly heavy China tilt I have in the past compared myself with Hang Seng, down -10.5% on total return basis. During the first 9 months of the year I struggled to keep equal steps with MSCI World, given the benchmarks high weight to the U.S. When U.S. markets sold off sharply towards year end I increased my alpha quite significantly against the benchmark. As you can see in the graph below, I was flat performance wise from mid-October to year end. This meant that my cumulative alpha reached it’s highest level towards year end. Total return is 47% since inception vs 22.8% for MSCI World. Although a negative year is not very encouraging, I’m still happy with the results, given how exposed I have been to China, which has had a terrible year.

Significant Portfolio changes over the year

Funeral investments – Dignity and Fu Shou Yuan

I entered into my demographics investment case beginning of 2018. It did not play out as planned, I changed my mind and sold both holdings in late November.

Brewery and liquor companies – Olvi, Diageo and Kopparbergs

Olvi and Diageo I still hold, I see them as defensive good companies, 2018 performance wise has been unspectacular. Probably Diageo is a bit too big company to deliver outstanding returns, it would be better to find something smaller, like Olvi, which I like a lot. My best investment was the one I sold, Kopparbergs, good return and the stock has totally collapsed after I sold. I think this was a case of my being a bit lucky with the timing, but also being ahead of the market understanding the cider business fairly well. Behind the scenes I have done a lot of research on other cider companies and how the big breweries are ramping up their cider offerings. I also done a lot of on the ground research, always checking stocks in stores around the world and in pubs of course. All of this made my change my mind on Kopparbergs prospects, selling has so far paid of very well.

Larger portfolio reshuffle – Selling Tokmanni, Microsoft, Catena Media and Criteo

This selling was partly due to my change in investment style. One reason was that these companies are hard to understand and grasp, therefore hard for me to have an edge against the market. Hard to grasp also means high maintenance to keep on top of what is happening. Performance wise selling these holdings was neither good or bad, on average they are about flat since i sold. So overall they were not bad stock picks, given that flat performance is also out-performing the market.

Special Situations – Radisson Hotel and Amer Sports

Radisson was my HNA related turn-around idea, which played out like clockwork. Somewhat luckily I bought at absolute bottom (24.1 SEK) and the stock repriced upwards before the bid for the company came. I choose to sell out before the actual bid at 35.8 SEK, whereas in hindsight, like one my readers has pointed out, it would have been better to keep holding it. Currently trading at 42.4 SEK.

Amer Sports was just that I had pretty good understanding of the Chinese company Anta, which had indicated a bid for Amer Sports at 40 EUR per share. The market did not really believe this, I saw it as something that made total sense for Anta. I got my shares for 34.1 EUR and sold at 38.37 EUR 1.5 month later, currently trading at 38.75 EUR.

HK listed small caps – Tonly Electronics, Dream International and Modern Dental Group

I have invested long enough now on the Hong Kong exchange to have confidence enough to invest in the smaller companies listed in Hong Kong. It’s pretty dangerous waters, mis-pricing can last for very long periods of time and many of the companies are not run with shareholders best in mind. Anyhow I found three companies which I believe had few of these dangerous characteristics, low valuations and fairly bright future prospects. To summarize, so far so good, all companies have out-performed the market, although under very low volumes. All these stocks are easily manipulated up/down 10% on a single day. When I bought Tonly and Dream Hong Kong was one of few exchanges that had sold off, and these stocks were in my view uniquely cheap. Now when valuations are coming down everywhere, they seem less and less unique for each day that goes by. It might come a point when these are still good investments, but there are safer options that are valued as low as these. Still I think there is some way to go before we are there.

Speculative/Opportunistic holdings enter the portfolio – UR-Energy, Scorpio Tankers, Irisity and JD.com

The timing (mid Sep) of me buying more speculative, loss making companies was not really fantastic. Just when the markets really started to tank. Given that it’s no surprise that these stocks have not performed very well, all of them being a significant drag on performance. Currently I have most hope to Irisity which is making some acquisitions, trying to consolidate Swedish knowledge on video/camera detection software. Given the market climate I might make some changes and lower the weight towards these type of companies, it might get very brutal in a bear market.

JD.com is also an interesting case, the rape charges were thankfully dropped. On the other hand China feels much more wobbly now than 6 months ago. I’m a few dollars under water on this position, a bit hesitant if I should keep it, due to this being 100% China exposure. As argued earlier, with stocks repricing, there might also be better opportunistic investments than looking for a bounce in JD.com.

Thoughts about 2019

I believe we have entered a bear market. Opposite to a bull market when the market grinds higher and has sudden drops downwards, I think one can start to see that markets rather grind downwards and have large jumps upwards. That is for me the strongest sign of a typical bear market. 2008 was a bit special, since that was more of a collapse. I don’t believe in collapse this time, rather a longer grinding bear market, like in 2000-2003. It’s not going to be very fun performance wise in the next few years if I’m right. It’s also going to be frustrating finding a good investment case, just to see it trade down another 20%, becoming even cheaper. On the upside, it will be like a kid in the candy store, with a lot of great investments and fantastic prices. Probably all of this will not play out in 2019, but continue into 2020 (if I’m right). As always these things are impossible to call and I will just try to hold my long portfolio through it all.

I recently read a book with the title: China’s Great Wall of Debt – Shadow Banks, Ghost Cities, Massive Loans, and the End of the Chinese Miracle. The author definitely has a negative bias on China but it struck a cord with me. I had not read the book when I wrote this post: Rotate away from China. He of course summarizes it much more nicely in his book, but he brings up a lot of points, which is just in line with my own observations. Reading the book it kind of re-emphasized that something pretty bad is lurking in China and when it turns, it’s going to be ugly. On the flip-side China still has many weapons to fight a downturn. Just the other day PBOC announced a Reserve Ratio cut for the banks which will release a lot of liquidity into the Chinese market. I think the big bad ugly China crash is still some years away, probably dependent on how much of a downturn we now will see in the rest of the world.

Portfolio Update & Changes (Amer Sports, Swedish Match)

After a very tough October, my portfolio has recovered somewhat and is in total down -1.6% on the year. That compares to MSCI World which is down -4.4% on the year. Both have achieved these returns, with the exact same volatility, 15.1% for the year (calculated on weekly returns). My correlation is 79.5% to MSCI World, which is rather high, but also somewhat expected. When markets fall correlation tends to increase between all equities (the correlation during 2017 was 64%). After being down to 0% cash, when I introduced my new three bucket investment approach, I’m now back above 10% cash after divestments in my funeral related companies and Amer Sports, which I will comment further on below.

Amer Sports – The Chinese are buying

When I launched my big portfolio change: GlobalStockPicking 2.0 – Major Portfolio Changes, it just happened that information came out about a non-binding interest from HK listed Anta to make a bid for Finish listed Amer Sports at 40 EUR per share. Having looked into Anta when I invested in XTEP, the other sport shoe producer I thought this really made sense. Mainly because Winter Olympics in China is coming up. So I used my new Opportunistic investment bucket to take a 4% position in Amer Sports at 34.1 EUR per share.

I wrote at the time: “My own expectation is that this should be priced at 85%*40 + 15%*29 = 38.35 EUR”. I think the market has caught up with my analysis now, given that the stock closed at 38.37 on Friday. I still think this will go through, but there are some small tail risks, that for example USA will block the deal. Usually these things also take quite a long time, needing Chinese approvals. So I’m happy to leave the last 1.5 euro on the table and close my position here. This netted my a 10% gain in USD (some currency headwinds) in a market which was down -9% for the period, very happy with that. As always when an investment goes well, you just wished your bet was a bit larger.

This is the second time I got a more short term bet right, where there was Chinese related corporate action around a Nordic company. The first time was the Rezidor/Radisson case (Adding Rezidor Hotel Group – HNA related idea) which also ended with a buyout from another Chinese company.

Swedish Match – Adding 30% to my holding

The producer of Snus and moist snuff which through countless of studies have proven to be much less destructive to your health than smoking. The stock has been on a wild ride lately, first the markets have been very positive on the possibilities for growth of Zyn in USA. Lately the focus seems to be elsewhere, for example that Swedish Match will not be allowed to sell it’s products in the rest of Europe. I think they have a terrific product as good as all the e-cigarette alternatives. The company is very well run and highly cash-generative. This is one of those companies I plan to hold forever, now was a good opportunity to add to my holding. I add about 30% to my holding as of close Friday, bringing this holding to 6.1% of my portfolio.

Defensive feels good in these times

For the frequent reader, you know that I have been skeptical of markets for quite some time. I have expressed this in many ways, but the main theme has been finding defensive long term holdings. Early on in the sell-off my defensive approach did not really work out, because the only thing that held up MSCI World, was the U.S. market and tech stocks in particular. Being underweight both was therefore short term not good for relative returns. Lately it started to work better though when tech “finally” stopped defying gravity. Defensive feels very good right now, but that doesn’t mean I want to miss out on the stocks with higher return potential, or very undervalued cases. I will hold true to my defensive style as long as the valuation difference to growth/value doesn’t become too large. Now I’m actually more excited about stock picking than I have been for quite some time. Today I find much more interesting investment cases than I did a year ago, one example of that being Tonly Electronics – Another Hong Kong value investing case. There are many more I have on my Watchlist and even some not yet mentioned there. The point of my dental series has been an attempt to find 1-2 companies to invest in, which are defensive health care companies I can understand. To summarize my defensive holdings:

What I see as defensive holdings:

Dairy Farm (7.9%) – Asia – Dairy Farm – Asian food giant

Swedish Match – Sweden/Nordic/USA – (6.1%) – Mentioned above.

Nagacorp – Asia- (6.1%) – Nagacorp – Casino in Cambodia, Nagacorp follow-up conclusions

Olvi (5.7%) – Finland/Baltic – Produces beer and other alcoholic and soft-drinks, selling mainly in Finland and the Baltic countries.

Gilead Science (5.2%) – Global – Biotech company with market leading products against HIV and hepatitis.

Essity (5.2%) – Global- New Holding Essity – Wood base hygiene products, like tissue paper, diapers, feminine care etc.

Diageo (4.1%) – Global – One of the worlds largest distillers with brands like: Johnnie Walker, Smirnoff, Gordon’s Gin, Captain Morgan and numerous others. Also Guinness is a large portion of revenue as well as its 34% stake in Moet Hennessy drinks division of LVMH.

Inditex (2.8%) – Global – The world famous clothing retailer Zara, so far keeps defying the e-commerce slaughter by producing outstanding clothes at a fantastically low price point.

Cash (10.7%)

Total = 53.8% of my portfolio is held in defensive companies or cash.

The above companies are a mix of daily needs, like food, clothes and hygiene and vices, like alcohol and gambling. All of the above holdings I’m confident to hold long-term, especially in a bear market. That doesn’t mean though that none of them will ever leave the portfolio. I try to think long term and get to know my companies well, something I didn’t appreciate enough in the past. Part of being long term is to not rush into the new investments, I will take my time and get to know new companies properly before investing. But if I find a new investment that feels much stronger than what I currently hold, the old will go out.

Currently thinking about

Lately I spent a lot of time trying the understand the Chinese tech scene better. There are a couple excellent podcasters out there who educate anyone willing to listen, on everything related to China tech. One thing that is very clear, is how extremely hot this sector is and how fierce the competition is. It seems to be on a totally other level than outside China. On top of that we have the Chinese government interfering in a lot of different niches. The competition and the intervention has again made me more negative in general. So the three of my holdings I’m currently thinking most about all have strong China and tech ties:

NetEase – Great company, with quality games and co-ops with western gaming companies. Given how much U.S. listed Chinese companies have been punished lately I think investors still really like this company, trading at a trailing P/E of 37 and estimated P/E of 24, is not dirt cheap. Obviously partly this is due to the halt in new game launches in China and everyone is expecting this to be temporary. Still, the government is showing who is boss and they won’t allow especially young people to be gaming addicts. Just as the funeral case, this hampers the upside for NetEase. Although I would argue that it probably very long term is healthy for the company to have more balanced customers and not school drop-out gaming addicts. The other aspect is the competition, which seems to be brutal. In Sweden a number of listed gaming companies have plummeted lately, it’s not that easy to keep delivering one of the few hit games everyone is playing. I have a hard time deciding of this a long term keeper or not, maybe the competition will eat up NetEase future? My Original Post on NetEase: NetEase – Chinese Gaming

JD.com – Here we have a company that is again fighting in fierce competition in the e-commerce space. The moat though and reasons for investing in this company is the fantastic delivery/logistics network they have built up. This is the hidden value in the company and the reason I invested. Some nasty details has been coming out about what the CEO has done in rape allegation case. It doesn’t feel very good to be shareholder alongside someone accused for something like this, but the company as such, I think is valued very low currently. If we disregard from personal feeling around the allegations (which is hard to do), this is in my mind a value investment at these levels.

Coslight – I haven’t written much about this company for a long time, it has been a big disappoint lately. This was an early investment for me on the theme of EVs and back-up power stations. The company has developed poorly due to needs for large investments which has been impossible with the already high debt levels (a misjudgment on my side). The solution became to sell of parts of the factory producing batteries for laptops. I think that was the best they could do out of a bad situation, but I’m not sure if they will be able to succeed to play with the big boys like Panasonic, LG, Samsung and CATL. Already back in 2016 it was clear to me I needed to wait until 2020, before EVs would start to sell in larger scale, now we are almost there. This should perhaps move into the Speculative bucket, but I held it for a long time and I will let this Electric Vehicle hype actually play out before I decide further on Coslight. The same reasoning goes for LG Chem, but there I don’t have doubt about their success, they are and will continue to be one of the market leaders. My original post of Coslight: Coslight Outstanding results

GlobalStockPicking 2.0 – Major Portfolio Changes

Before I start this post, I just have to comment on the last months terrible portfolio performance. After being comfortably ahead of the MSCI World benchmark, I’m now behind by almost 5% on the year. The portfolio is down nearly -8% in 1.5 month. Some of it, is company specific stuff, like the gaming halt in China (NetEase). Some of it is just general Emerging Markets and China sell-off, versus how strong USA (which I’m heavily underweight) is in comparison. A picture says more than a 1000 words:

Now over to something more fun than my under-performance, which I’m not too worried about, its bound to happen, especially when you have such large regional tilts.

GlobalStockPicking 2.0

In a recent post I laid out my new and hopefully improved portfolio construction/allocation. I summarize my new portfolio construction in the following three buckets:

Long Term

The idea is to keep the main focus on the long-term portfolio. This bucket contains about 15 stocks and carries the majority weight (65-90%) of my total portfolio . Given a 5+ year holding period, this implies that I should not change more than 3 holdings in a year. I did not put that as a strict requirement, because sometimes more action is needed. But the Target Holding Period defined above is really there to imply that this should be a low turn-over portfolio of great long term holdings.

Opportunistic

I have been following stocks and the market so long now, that I see stocks that are miss-priced for one or another reason. When I see the risk/reward as favorable, I now have the flexibility to take part on a more short term basis. The analysis on my side here could be anything from very deep to more shallow.

Speculative

I’m not sure if this the gambling genes in me that likes this so much, but I just love speculative stocks. I added this investment bucket for two reasons:

1. I spend quite a lot of time researching and reading about these kind of stocks. I think I sometimes actually have an information advantage (that is yet to be proven).

2. Because its fun. Investing is mostly serious business, but it should also be fun and exciting.

Portfolio Changes – Selling 3 holdings

It will take some time to have a portfolio that is fully in line with the above buckets. I think for example the Opportunistic cases I present today are not the strongest ideas ever. Nevertheless I think they are good enough to enter my new and shiny three bucket investing strategy. Below I will go through what has to leave the portfolio. At a later stage there still might be 1-2 long term holdings that needs to be evaluated if I’m really comfortable holding long-term.

Kopparbergs – Sell Full Holding – 5% investment return

Since I bought into Kopparbergs I spent quite a lot of time, Peter Lynch style, looking at cider products in stores around the world. Walking around daily life, like in a supermarket is just full of investment opportunities don’t you think? In fact this is in general something I draw quite a lot of inspiration from. The more important step in that process is both figuring out what you think of the product compare to its competition and more importantly, how other people feel about it. In the case of Kopparbergs, I think that competition has stepped up significantly and consumers are now having choices similar to Kopparbergs. Kopparbergs more or less created a new cider segment, with very sweet cider. From what I see in stores, although less sweet, for example Carlsbergs Sommersby cider is extremely popular. My case was that Kopparbergs cider had a good chance of being a hit in the US, I now changed my mind about that and see it as less likely. Kopparbergs product offering is not strong enough to really stand out in this competition. Another important factor is that selling these products is as much about distribution and network as in having an awesome product. For all the above reasons I decided that the likelihood of Kopparberg continuing a strong growth journey in cider sales, is low.

Original Kopparbergs investment case

ISS – Sell Full Holding – 15% investment loss

A behemoth in property services, mainly related to cleaning with almost ½ million staff is an impressive entity. My investment thesis was a turn-around in free cash flow after paying down debt and after that a significant dividend increase. That didn’t really play out as planned and the stock market has also been as disappointed as I. Selling this holding is for totally different reasons though and that for me is too low growth opportunities. This is a steady (potentially) high dividend paying company. Although high dividend stocks have many nice characteristics, it’s not really what I look for in a long-term investments. There has to be both growth and dividends. Mature businesses which are just fighting with operational efficiencies is not what I believe will generate alpha long term. It might do so in a bear market, given the stability and quality of the company, but I’m not going to hold ISS as a timing play on a bear market.

I will have to expand what I look for later, in my Part 2 of the “Art of Screening”

Radisson Hotel Group – Sell Full Holding – 39% investment return

I’m usually pretty tough on myself and my investments failures. That’s because I’m not here to brag, but to become a better investor. But now I will do a bit of bragging. Damn it feels good when you are spot on in an investment idea. I painted out a investment scenario whereby HNA would be forced to sell it’s position in Rezidor (now renamed to Radisson). On top of that I had listened to a 3.5 hour investor presentation on how the hotel group was going to structure it’s turn-around. So it was a double whammy turn-around + bid case. As it happened the market started to believe the turn-around, especially when it already started to show in the latest results. Then came the bid by a Chinese hotel company: HNA sells Radisson Holdings to Jin Jiang-led consortium.

Unfortunately this bid did not give as much of a stock price bump as I had hoped. There is still some un-clarity around how much Jin Jiang will need to offer the minority holders, but they might low ball investors and keep the stock listed. There still might be more upside here, but my investment case has played out and I’m happy stepping off here, overall a great investment which returned 39% in less than 6 months.

Original Radisson/Rezidor investment case

New Holdings – Adding 5 holdings

I will at end of trading today add 5 new holdings to the portfolio, and after selling the 3 above holdings, this is what my new 3 bucket portfolio will look like:

Short comments on new holdings

Obviously this will need to be expanded over multiple posts, but here is the quick and dirty on these 5 new holdings:

Amer Sports – Opportunistic – 4% position

Since my previous investment in Xtep, I have both researched and followed the Chinese sportswear and sport shoe producers in China. I invested in the one (Xtep) that was trading cheap on all kinds of metrics. If I had taken a more long-term approach, perhaps I should have considered the local champion Anta instead. Anta which is a 13bn USD MCAP company recently showed a tentative interest in bidding for Amer Sports, a Finnish holding company for a long list of attractive brands/assets. The tentative offer was at 40 EUR per share and the stock quickly after repriced from 29 EUR to 36 EUR, but has after that come down to 34 EUR. If one wants to play mathematics on that, one can say the market is pricing about a 50% probability of this bid actually going through.

My investment case is two fold:

- I liked Amer Sports already before this bid and had already done a quick due diligence on the stock. Even if the bid falls through, I’m not in panic mode holding this stock, it could convert to the long-term time bucket if I did a deeper due diligence and like what I see even more than I already do. There has already been other speculations that Amer might spin-off parts of its business to unlock value.

- The market is way too skeptical on the bidder in this case. I take this as typical “China fear”. This investment, so makes sense for Anta. If and when it goes through I will be very compelled to add Anta to my long-term holding bucket, I think they would do great things with Amers portfolio of companies. We have Winter Olympics coming up in Beijing 2022 and Amer holds several “winter” assets. Anta has the network in China to actually being able to grow these brands in this tricky market, in the past Anta has bought the China rights to the at the time quite poor brand Fila in 2009. They have totally re-positioned the brand in China over these years, growing it into a real success, from 200 to over 1000 stores in the country. I put the probability of Anta being serious with this bid at 90-95% and I take the probability of a successful takeover somewhat lower (85%), since there is some overhang with for example USA wanting to meddle in this, given that many of the brands under Amer are tightly related to USA.

My own expectation is that this should be priced at 85%*40 + 15%*29 = 38.35 EUR, giving about 12.5% upside on current market price of 34.1 EUR.

JD.com – Opportunistic – 4% position

In this pretty brutal China sell-off I have been scratching my head if and when I should poke my hand in trying to catch any of these “falling knives”. I somewhat randomly felt that now would be a good time to catch one of the stocks I have been looking at for quite some time. JD.com is the case of a quickly growing e-commerce company with tremendous revenue growth. The company plows all of the cash back into investments in its own business and other businesses. For example it’s a co-investor in Yonghui Superstores, which my largest holding Dairy Farm owns 19.99% of. For a primer on JD.com I kindly refer to Travis Wiedower who presents the case in his investor letter: JD.com in Letter, EGREGIOUSLY CHEAP blog.

What has taken this fall into another gear, is what happened recently to the CEO of the company: Richard Liu of JD.com Was Arrested on a Rape Allegation, Police Say

A pretty disastrous allegation having hanging over you, I will refrain from speculating in the probabilities of this being true. The main point here is that at this stage the company is bigger than Richard. Yes, Richard built this company and yes this will have a negative effect on JD’s perception among the Chinese. What did Richard do in the US when he got arrested? He was actually studying at Carlson School of Management to complete the American residency of a US-China business administration doctorate programme. Having time for these types of studies shows that other people are running the company by now. There is some issues with the governance structure if Richard would be imprisoned, but we very far from that right now, he is not even charged yet. Richard has built a fantastic business in China, in many ways better than Alibaba’s model. My best guess is that these allegations will die out and JD.com will on a 1-2 year time horizon trade significantly higher. When/if this allegation overhang is removed, this might move into my long term time bucket.

Irisity – Speculative – 2% position

The company listed in 2013 under the name Mindmancer. The idea was to provide smart camera surveillance systems to construction sites, schools and such. The whole package of software imagine recognition, cameras and installation was provided by Mindmancer. They had some success and have installed this in numerous places over these last ~5 years. The problem was that the business model didn’t scale and it was hard to keep the company profitable. There was also management issues, where one of the founders, a very young an enthusiastic guy was the CEO. He probably had the heart in the right place, but was to inexperienced to run and grow this company. The largest shareholders which is connected to the University in Sweden where the company started, decided to appoint a new CEO, change the name of the company to Irisity and do a rights issue (24 MSEK at 7.8 SEK per share) to strengthen the balance sheet. After that the new CEOs strategy has been to go for scalable sales model, just selling the software they develop. The software is proven in all the live conditions where it has been installed already. They are going for so called Software as a Service (SaaS) model. Somewhat surprisingly this quite quickly has got a lot of interest from market participants, both G4S and several of the worlds largest camera producers.

A somewhat sloppy google translate of one of their press releases recently (Irisity press releases):

“Irisity AB (publ) signs license agreement with Hangzhou Hikvision Digital Technology Co. Ltd.

Hikvision is the world’s largest supplier of innovative video surveillance products and solutions. With 20,000 employees, including nearly 10,000 in R & D, the development of intelligent cameras leads. Hikvision is listed on the Shenzhen Stock Exchange with a valuation of USD 46 billion. The company shows a strong YoY 32% growth, with sales of USD 6.6 billion (2017). In collaboration with Hikvision, Irisity now evaluates embedded integration of IRIS ™ AI software in Hikvision’s camera platform.

– Hikvision is a wish party to Irisity, we already have our AI with several of their IP cameras, but are also looking forward to creating a Linux embedded solution right in the camera. This is the future, since very few cameras will be delivered without built-in AI! Comments Victor Hagelbäck, CTO on Irisity.”

What is not mentioned in the press release is that Hikvision produces almost 100 million cameras per year, so the potential is gigantic if these companies really like the Irisity software.

So to summarize, the company has a proven product in the Nordic markets. They are currently trying to convince huge players, that its software algorithms are good enough. In a best case they would want to pay Irisity to embedd them in their products. Right now this license agreement is not worth any money, its just shows that Irisity has got to actually showcase their products and on some level for example Hikvision (several other big companies are doing the same) is evaluating their product. I find Irisity (valued at about 35m USD) at a very attractive risk reward right now, even if the probability is very low to see large orders. This is truly speculative, one of these lottery tickets, but with much better odds than playing the lottery.

Scorpio Tankers – Speculative – 2% position

This is a fairly simple case, market analysts seems to think that Day Rates should normalize. They have not done so, so far. Equity markets have given up and stock is tanking (ha ha). Taking the long term view on day rates, its seems plausible that they would increase from these levels. I’m a firm believer in mean reversion. Scorpio has a attractive fleet of new vessels, as long as day rates recovers somewhat, they are highly cash generative. Let’s see if that happens or not.

UR-Energy – Speculative – 2% Position

Canadian listed Uranium miner, that I actually owned already back in 2006-2007. At the time, it was the only junior Uranium prospecting company, that actually came out on the other side of the bull and following bear Uranium market. They are now a small scale Uranium producer, with a large portion of their production hedged at higher levels. I will have to write another time about Uranium, but its a very special market and a strong case can be made for long term increases of as its called yellow cake. I’m choosing UR-Energy as my Uranium proxy, because they have excellent management, a very crucial detail in the mining industry, which is full of crooks and cheaters.

Please comment what you think of my new holdings and I will try to follow up with more details in later posts!

Portfolio holdings – half year review

Year to date the portfolio is up +3.5%, compared to MSCI World at +0.8%, both including dividends (so called total return). My portfolio has in the past generated it returns with significantly higher volatility than MSCI World. You can almost see it in the graph below how stable the upward trend was in MSCI World. Interestingly enough now this year, when markets have turned more volatile, my portfolio volatility is slightly lower than MSCI World, at 15.2% vs 15.8%. Downside volatility is what counts and I think this is one proof that I managed well to create a defensive portfolio, which has been one of my aims, many other aims were discussed in my previous post earlier today.

Total return of GSP portfolio vs Benchmark

Total return of holdings since investment

Notable winners/losers during 2018

Some comments on the largest gainers and detractors during this year.

+ Swedish Match

The Swedish tobacco company has performed very strongly compared to its sector colleagues. Then again Swedish Match is a very different company selling smokeless tobacco products. For the interested reader this is a good primer on snus: New York Times on Snus. Except good results, one reasons for the strong share price performance is spelled ZYN. Which is a tobacco free nicotine pouch, which recently has become a big hit in the US. Swedish Match has recognized this and is spending 60 MUSD+ in increasing capacity over the coming to years of ZYN. Valuation short term is a bit stretched, if I had a larger position from the beginning, now would be the time to scale down the position somewhat, unfortunately I started of with a very small position. I’m willing to continue to hold 5% of my portfolio in this excellent company.

+ Fu Shou Yuan

One of my two funeral company investments, they truly went in opposite directions. In a very poor market environment this stock has been on a tear since I invested. The price momentum strength in this stock is almost a bit scary considering how weak the Chinese markets been lately. At these multiples/levels I have to say I’m close to scaling off a bit of this position. That will depend on if I find somewhere better to allocate my money. Here I also want to mention my fellow blogger who wrote an excellent analysis on the company: C for Compounding on Fu Shou Yuan.

+ Dream International

Another new investment that also just kept on its upward momentum. Since I did my analysis on the company I have understood a bit better what kind of plastic toys is driving this fast growth. The understanding came from a deeper analysis of newly US listed Funko. Basically a lot of the Funko’s toys called Pop! are collectible items. Just search for it on Youtube and you will find a lot of people like this guy: Funko Pop collector. The funniest one I found was a contract written up between husband and wife: Funko Pop contract – Limiting spending. This makes the picture a bit more clear how Funko in just a few years has become such a big player in the plastic toys industry. I see this as one of my strongest investment cases, therefor it also carries a large weight in the portfolio.

– Dignity

My second funeral stock has not done nearly as well the first one. I decided to double up in this stock after the fall of 50% in one day. That seemed like a very good move for some time. Actually I was close to making up the whole loss about a month ago, then the stock was hit again. This time it was due to UK’s CMA (Competition and Markets Authority) who launched a review of the countries funeral sector, to make sure “people are not getting a bad deal”. It seems after this most investors have given up hope on the stock. I haven’t really given up yet, since the reason for the rebound after me doubling up was that actual results came out much better than anticipated. We are still looking at a totally non-cyclical company, with a estimated P/E of about 11-12 and a dividend yield of 2.4%. As mention in previous posts, the worry is the debt load in case profit margins fall significantly further. I’m stubbornly keeping this one.

– LG Chem

After being one the portfolios true outperforms and a holding I had for a long time, LG Chem has given back much of that out-performance over the last few months. The stock is fairly volatile and living its own life, but the downturn is likely due to the oil price. This volatility from the Chemicals division is something I will have to live with, since I didn’t invest in more pure play like Samsung SDI. The reason why I’m owning the company is not due to the Chemicals division, but because the company is truly in the forefront of EV battery production. Now we are 1-2 years out for the start of really widespread EV sales from all the big car companies. My plan is to ride this whole wave and hopefully hold this company for another 10 years.

– Coslight

Similarly my idea with Coslight was that it could become a Chinese large player in the EV battery space. I’m less sure now than I was 3 years ago that actually will be the case. Not because Coslight is not going to try, but because the company does not really have the financial muscles to build up huge modern EV production plants. Like for example the newly listed CATL can do, or BYD for that matter. Coslight has proven itself as one of the largest producers of laptop batteries, so they have the know-how to make batteries cost efficiently, but I’m starting to feel less sure if that is enough. They sold of a portion of one of their factories to reduce debt and free up capital to invest further into EVs. Overall it was a good move for us that wanted the company to move towards EV battery production, but the market has not really received this news well. A tricky holding I followed for a long time, before I had a lot of conviction. I think the reasons why I’m not giving up on this company, is that they have truly hidden value within the firm. Strangely enough (due to the majority holders son) the other leg of the company is video/mobile games producer. The best case would be if they decided to list the games entity separately. The games developer might be valued at perhaps a third of whole Coslight’s value, given the multiples on games developers these days.

Summary

As you can see from my discussions above, some holdings I’m happy with, others more worrying. Given this, I still need to keep up the hunt for at least 2-3 new investments. I will also consider if I should increase the weights in some of my current holdings, to not keep cash levels too high. In general that has been a problem in the past and really big performance detractor, since I calculate 0% return on cash.

Reflections on top 5 holdings

In the graph of portfolio performance dividends are included, but in “Return (in USD)” of current holdings dividends are not included.

Holding comments

As you can see above, my portfolio has become more diversified than ever before (18 holdings). I would say the reason for that is the high valuations we currently see in stock markets. I used to at least find cheap stocks in the Chinese markets, but not so much anymore. In frustration over finding anything that feels like a home-run investment, I have gone defensive, both in the style of my holdings and also diversifying into a broader portfolio. With this kind of portfolio I do not expect to outperform as much as I have done in the past. Below I will give comments and thoughts on the larger holdings in the portfolio. Before I start I would like to mention Catena Media. I bought into the company when the stock price was falling rapidly from it’s highs. Soon after I bought the CEO was fired and the majority owner took over as CEO. It was a tough decision to hold on to the stock, as people speculated that the quarterly report would show some major issues (perhaps why CEO was fired). But no such thing happened, rather afterwards confidence grew in the company again. When I sold the full position in Catena it was actually the largest holding in my portfolio and a strong contributor to me managing keep pace with the benchmark. Now let’s focus on the five largest holdings in my portfolio:

LG Chem

Previous posts (LC Chem posts)

I have not commented that much about LG Chem, although it has moved up to be my largest holding. The investment traces back to my investment theme 2 years ago when I started the blog. The six months before the blog was launched I had spent a lot of time to research the whole value chain of Electric Vehicles (EVs). I ended up concluding that it will be very hard to forecast a winner among the many car makers. As a side note I did and do still have a belief that Chinese automakers will step up and take a large part of the global vehicle sales pie. I looked at three segments of the value chain, mining companies, battery producers and semiconductor companies. Semiconductor companies I dismissed, since at the time I saw it as more linked to smart/self-driving vehicles. It then came down to mining or battery companies. When I looked into the supply situation of Lithium, from what I could gather there was actually plenty of supply, the bottleneck was rather Cobalt, but here there were no decent investment options. Batteries also had the tailwind of Energy storage systems, that could potential ramp up demand substantially on the back of more Solar energy usage. So batteries became what I focused on. LG chem was and continues to be a world leader in battery production, with the most advanced batteries in terms of performance vs price.

The problem with LG Chem, was like most of the investment cases around the EV value chain, it was not a pure play. Most of LG Chem’s revenue comes from chemicals sales which is totally unrelated to EVs. I tried to analyze the chemicals business best I could, but it is a complex field. I understood that I did not buy into something at peak valuations, but rather chemicals where trading at somewhat depressed levels, my analysis did not really go deeper than that. I reasoned that expanding battery production, to meet the enormous future demand, would require a sizable company with muscles to expand. So without knowing that much about the chemicals business, I saw it as a good backbone to build the battery production capacity on. And that is more or less what LG Chem has been doing. Capex and R&D expense is planned to increase substantially in the coming years, on the back of strong cash-flows in the last quarters.

Looking at the future, worries lies in if there will be any substantial margins left for the battery producers. As Chinese new giants like CATL steps up to the plate, it would not be the first time a thriving profitable industry, becomes like the solar industry where huge volumes are produced, but no money is made. What keeps me somewhat comforted is that there are safety and quality aspects to these batteries produced, which means that a battery product is not just only about cheapest possible price per kWh of battery power. There are also more long-term quality and safety aspects to a battery product.

Even after the strong share performance, the company is trading at an undemanding trailing P/E of 15 and a estimated forward P/E of 13, which is in the middle of the range of it’s long-term P/E band. I would argue there is still room on the upside, even short-term. Since we are closing in on the S-curve area of EV adoption, where LG Chem is bound to see strong Revenue growth. A few years ago, it was estimated we would see substantial EV sales come through around 2020. But it’s more likely that most cars will be Plug-In hybrids around 2020 and pure EVs really taking of on a massive scale, is still probably a few more years into the future. But say 2025, I’m certain 75%+ of all new cars sold will be either a hybrid or a full EV car. If LG Chem manage to keep in the forefront of battery production, it is a company I’m very willing to hold for the coming 10 years.

Dairy Farm

I recently wrote a long analysis on this company, you find it here: Dairy Farm Asian Food Giant

Dairy Farm being a conglomerate within a even larger conglomerate. One could argue that instead of buying into Dairy Farm I should take a position in the whole Jardine Group. But I do like being exposed to food in the Asian region. Food is of course important to everyone around the globe, but Asians are in my view even bigger foodies than westerns. As the region grows richer, which its more or less bound to do, if Dairy Farm plays its cards right, it should be able to long term leverage that trend. Of course it is a highly competitive market, but with the Jardine Group behind it, Dairy Farm has all the advantages you could have for this region. I see this as a very long term holding, which I would only re-evaluate if I saw that something major had changed in the direction of the company.

XTEP International

I invested in two steps into XTEP, you find my thinking at the time here: XTEP Posts

The more I learn about Hong Kong listed companies and market participants, I realize mis-pricing are more common, or at least market participants have another time horizon and sentiment shifts in their investments. When the sentiment finally changes, it’s a bit like the famous ketchup bottle, positive momentum builds quick and reprices the stock to a new level in a very short time. For a stock picker that is of course a good thing, if you can get in before the sentiment changes. But you also need to be very sure about what you are investing in, since your patience and thesis will be tested. XTEP has had a a similar story of under-performance and then a catch-up. The clear winner though has been the largest company Anta, which since I invested has continued to outperform its peers.

When I invested about a year ago, XTEP was the ugly duckling, trading at a much lower P/E than its peers. One of the reasons as I have understood more clearly is that XTEP competitors are aiming more for the branded high priced segment, competing with Nike etc. XTEP has had it’s niche more towards the cheap/affordable running shoes. Much of the growth trend (so far) in health and sport awareness among Chinese has been in the more affluent population which obviously will go either for western brands or top Chinese brands. I tried with this investment think second level, that since healthy living and exercising already is a strong trend in China among rich people, that maybe it would also affect the middle class population to consume more sports shoes. The jury is probably still out if XTEP will succeed in this.

Looking to the future, I think the sports apparel segment is a good segment to be invested in. The tailwind from Chinese consumers on these type of products should continue. If XTEP is a good enough company in terms of execution and brand building, that I’m less sure of. Basically because I’m not in touch with its customer base, or consume their products myself. So the case for me to generate alpha in terms of stock picking, is lower here, where I only go by what I can see in the data. For these reasons I will probably never be fully comfortable with this as a very long term investment and my strategy lately has been to ride this positive momentum that finally arrived and look for a good exit level in this holding.

Gilead Science

My initial thoughts when I invested: Gilead investment

I was reflecting on that I spent a lot of my research time on looking at Health Care/Pharma companies of different kinds, everything from more niche small cap companies producing probiotics or vaccines, too large companies like Teva. It’s a bit ironic then that currently I only hold one single Pharma company, and that is a company I spent less time researching myself and more followed the results of others that I respect for their knowledge. WertArt’s excellent analysis helped my jump the boat and invest. Since I invested Gilead has made some larger acquisitions, again I’m not competent enough to understand if this was positive or not. I can only see that the Gilead management has had a fairly good track-record in its larger purchases.

The question to ask myself really is, since I seem to have no to a weak edge in being able to understand and analyse big Pharma companies, should I even invest in them? I’m not a benchmark agnostic investor and the Health care segment has 12% weight in MSCI World. With such a large weight in the benchmark I would rather say that I want to hold at least one Health Care company. For now I’m happy holding Gilead as a good pick in the segment, but I will do my best to find smaller companies in this sector, which are easier to grasp.

Huhtamäki

Initial reasoning for buying into Huhtamäki: Rotate away from China – New holdings

In a very fragmented market Huhtamäki has managed to take a strong position in the food packing market by doing a large number of smaller acquisitions. Food packing I believe has a long-term strong tailwind. In terms of risk I see a trend where large companies decided to be more eco-friendly. Seeing the documentary “A Plastic Ocean” makes you very sad of. We treat our environment in a horrible way in terms of plastic packaging. Maybe in parts of the world, there will be trend towards more paper/wood based packaging products. Huhtamäki today does both, so even this I don’t think is a major risk long-term, although short term it could create some losses if the plastic production facilities would become underutilized.

In the case of Huhtamäki a full analysis of the company is long overdue, it’s something I kept pushing forward as I feel I understand the company fairly well. The truth probably is somewhere in between since I have not sat down and looked at detailed figures of the company, reading many of the previous annual reports etc, as I usually do when I fully analyze a company. Instead of doing a half-hearted attempt here now, I will instead try to deliver a full analysis of the company in the next few weeks.

Portfolio Changes – larger reshuffle – Part 1

Thoughts on investment philosophy

I have recently had quite a lot of time to contemplate my investment style and philosophy. I think I reached some conclusions. After all that is what this blog is about for me, learning from and seeing my mistakes more clearly and then adjusting accordingly.

Before I started this blog I have during periods followed the market and specific stocks very closely. I have used technicals and fundamentals to swing-trading holdings (3-12 month horizon) with fairly decent results. Meaning that I see the stock as fairly/undervalued with a chart that looks good for a move up. I then later sell when the stock is more close to fully valued. To some degree I have implemented such a strategy also for my blog (for example Avanza, Ericsson, YY, Shanghai Fosun etc). But this is very different from believing in a company truly long-term, even if the stock gets ahead of itself valuation wise. Given that I do have a full time job and this is a hobby, the time I can spend on updating myself on holdings vary widely. From another perspective baby-sitting such swing trade positions takes away valuable time from researching new interesting companies and sectors/niches.

All in all the conclusion for my future investment strategy is stop looking at these companies that trade cheaply currently and then start to swing them in/out of the portfolio as they get cheap/expensive. If all stocks in the world would be drifting sideways forever with some volatility this might be a successful strategy, but that’s not a very likely scenario. Instead I will focus on what makes more sense, finding great companies. Preferably currently cheap, but anyhow companies that in 5 years time in my view has a high probability of trading significantly higher. I should also at all times be comfortable turning to stop following my holdings and be happy to own them for the coming 5 years. Currently I do not hold such a portfolio and I intend to spend the coming months to do just that. This means that I am tilting my portfolio more towards Quality, which in general is expensive now. But I intend to find my own type of Quality, not necessarily Nestle and the likes (nothing wrong with Nestle though)

In terms of Portfolio management I will still allow myself to trim holdings that grow very large or add in holdings that have under-performed but I still believe in. And of course I will still make mistakes and mis-judge companies, meaning they will not sit in the portfolio for 5+ years, but till be sold when my view has changed. But preferably the investments should be such so I won’t be easily swayed in my judgement of the future prospects of the company. For example an oil company with great management and execution might be dead in the water if oil production cost is around US$60/barrel and oil drop to US$40, so before I have a very clear and sure long-term view on the oil price, it would be a silly investment to add to this portfolio. I take this as an example because currently outside the blog holdings I do have a swing-trade position in a what I think is a very decent oil company (Tethys Oil).

Reshuffle of Portfolio – Part 1

Not only have i contemplated my strategy, but another reason why I have written so little lately is that I have been very busy re-searching a larger number of companies. Most of these investment ideas will materialize in new holdings over the coming months. It probably won’t be perfect, since I change so much at the same time. Minor adjustment might come later. But all in all it’s holdings more in line with a more long-term investment strategy. The holdings are in general also more defensive than what I currently hold. This I also very much what I seek in such a late stage bull-market. I’m not sure if I should call it new Themes, but I chose to allocate significant capital to two industries below, 1. Funeral Services and 2. Alcohol and Beverage related companies. In due course I will try to expand on my thoughts behind these investments.

Dignity – Add at 5% weight

Funeral service business in the UK. I had my eyes on for some years now and lately a very good buying opportunity arose. I heard about it for the first time from a long only manager and have since understood what a wonderful business segment funeral service is. Firstly from a margin perspective. but also how fragmented the business is and the possibilities for a cash flow generating company to buy these small companies at attractive multiples.

Fu Shou Yuan – Add at 4% weight

Basically the same story as Dignity above, funeral services, this time in China. This stock I’m perhaps not buying at the right moment short term, as it has traded up and is actually very expensive at the moment, but from a long term perspective I’m very comfortable holding this.

Diageo – Add at 4% weight

Has a portfolio of high quality liquor brands. Also has a minority holding in Moet Hennessy which I find interesting. Overall the thesis here is that they will continue to leverage their strong brands and their tremendous track-record of shareholder returns. For example the portfolio of whiskey brands probably is 50% of all top quality brands available.

Olvi – Add at 4% weight

I have searched for quite some time for a way invest in line with my positive view on the three small Baltic countries, I think this might be one good way. I also have fairly bullish view on Finland, finally coming out of some economically challenging years. This is a family owned (through voting strong shares) beer and beverage company with exposure to the above mentioned countries. They have also shown a tremendous track-record of execution. Overall, smaller listed beer and beverages companies start to be as common as unicorns. I will expand on this later, but not many are listed anymore. As uncommon they are, its seems to be a fantastic business to be in. Since almost all companies shows great returns (until they are bought out) with very strong cash flows. Previously I held Royal Unibrew for mostly the same reasons (I should have kept it), but overall I find Olvi more attractive, with a stronger track-record.

Tokmanni – Sell Full Holding

This was also a play on Finlands recovery and that the company felt cheap with a good dividend. But they continue to under-deliver and the last straw was the mess with the new CEO not being allowed to start due to a non-compete clause. Felt very unprofessional. Also nothing I’m very confident to hold in 5+ years, with what currently goes on in Retail. I’m happy coming out of this one with a small profit.

Microsoft – Sell Full Holding

A great company of course, but current Tech-hype is just too much for me. If/when Tech companies re-price downwards I will definitely be looking at adding 1-2 Tech holdings again. I’m happy for the returns I got and unfortunately I cut my position in half way too early, the part I kept returned almost 80%.

Catena Media – Sell Full Holding

This became the latest of my “swing trades”, with over 40% return in less than 4 months one of the better ones as well. I was a bit torn about this holding, since I do see some good long-term prospects. The online gaming business will grow, and these sites really need channels which supply them with customers. But it’s a way to unstable business case for me to comfortably hold for many years. It is definitely in the “baby-sitting” category, where I felt a need to keep myself updated on a frequent basis. So with a bit of a heavy heart I sell this holding. This could for sure keep performing very well for a long time, but I categorize it in the “too difficult” pile.

Portfolio Review Q3

The third quarter of the year has passed and the bull market is still roaring pretty strong. My guess a few years ago would have been that we should have seen a larger setback by now. On this particular point I feel pretty humbled by being wrong for so long. Performance wise I do not feel as humble. I have done quite a number of things wrong during this year, mainly selling stocks too early. But in general I did more things right than wrong and that’s what counts. Let’s go through the performance and some high- and lowlights.

Performance

Year to date the Global Stock Picking portfolio is up +24.5%, that compares favorably to MSCI World (Total Return) which is up +17.4%, but lagging Hang Seng (Total Return) which is up an incredible +29.3%. Looking at risk adjusted returns, I’m not faring that well though. Although I have run a large cash position (which lowers volatility) the volatility YTD is at 10.5%, compared to MSCI World at 5.5% and Hang Seng at 11%. So risk adjusted I come out with the worst Sharpe ratio of 2.33 vs 2.66 for Hang Seng and 3.17 for MSCI World. I guess that also says something about the state of things in the markets when a Global Index portfolio is returning a Sharpe >3.

I probably sound like a broken record soon, but this to me is a very late stage bull market and one should plan accordingly. I did make an attempt to discuss the topic recently (Where to hide – a factor approach).

Compare with Hang Seng?

That I have added Hang Seng as a comparison might be somewhat misleading, since my intention is to run a Global portfolio. The reason why I added Hang Seng was due to my heavy China tilt when I started the blog. I would argue that is not a constant tilt that I will have over time. It was an allocation call I made at the time. It is a call I’m obviously happy about, since it has given me free Beta out-performance against MSCI World, which is my true benchmark.

Lately I worry about the Chinese economy and the valuations has got more stretched also for Chinese stocks. As you know from previous posts I actively rotated away from China. Currently my portfolio has 16.5% of its cash invested in companies with most of its earnings from China (Coslight, XTEP and NetEase). I will keep the Hang Seng comparison for sometime, but I might remove it at some point.

Highlights

Buying Gilead became a very well timed investment. The market really liked the new product line their are buying themselves into through their acquisition of Kite Pharma. I honestly don’t have the knowledge to know if this will actually be so fruitful as the market seems to think. My impression is that (the market thinks) Gilead has a strong acquisition track record.

Nagacorp which we discussed extensively in the comments and I choose to double up on has come back to something closer to fair value. The company continues to execute well on attracting more VIP players and the Naga2 complex is about to open in full scale. Next Chinese New Year will be very very interesting, I’m optimistic about further share appreciation. As long as the majority holder does not decide to do something stupid (again).

LG Chem which is my long long term holding for the EV-theme (being a leader in battery technology) has performed very well lately (although not as well as the pure-play Samsung SDI). Unfortunately the battery part of LG Chem is still fairly small. I expect it to grow substantially over the coming 5 years.

Lowlights

I made a bet that XTEP, the Chinese shoe company was lagging it’s competitors who have all had great runs in the stock market and would do some catch-up after it’s semi-annual was released. It turned out being the opposite and I doubled up before the stock collapsed. I feel a bit beaten up, picking the only Chinese shoe company that is down performance wise. Still haven’t given up though, although less about my position than before.

In my move to rotate away from China (Time to rotate away from China) I have sold a number of holdings lately. Two which I sold after very strong returns were YY and BYD. It has been a bit hard to see the shares continue to surge another 30-40% after I sold, but such is life. As I wrote at the time for YY, I got scared of the Chinese Gov clampdown on streaming services, but these things often go away and so it did. And the upside I saw very shortly after came true.

Catena Media which I just bought into also had a negative event right after I bought. The CEO was fired with immediate effect. This gives me some worry that something might surface in the Q3 report. I have considering to reduce my initially fairly ballsy position. The only positive keeping me from doing it is the interim CEO which I have very high hopes about.

I bought two bricks and mortar stocks, XXL and Tokmanni, I reversed my decision with a smaller loss for XXL and kept Tokmanni. So far I should have done the opposite, since XXL has rebounded nicely whereas Tokmanni is treading water.

Current Portfolio